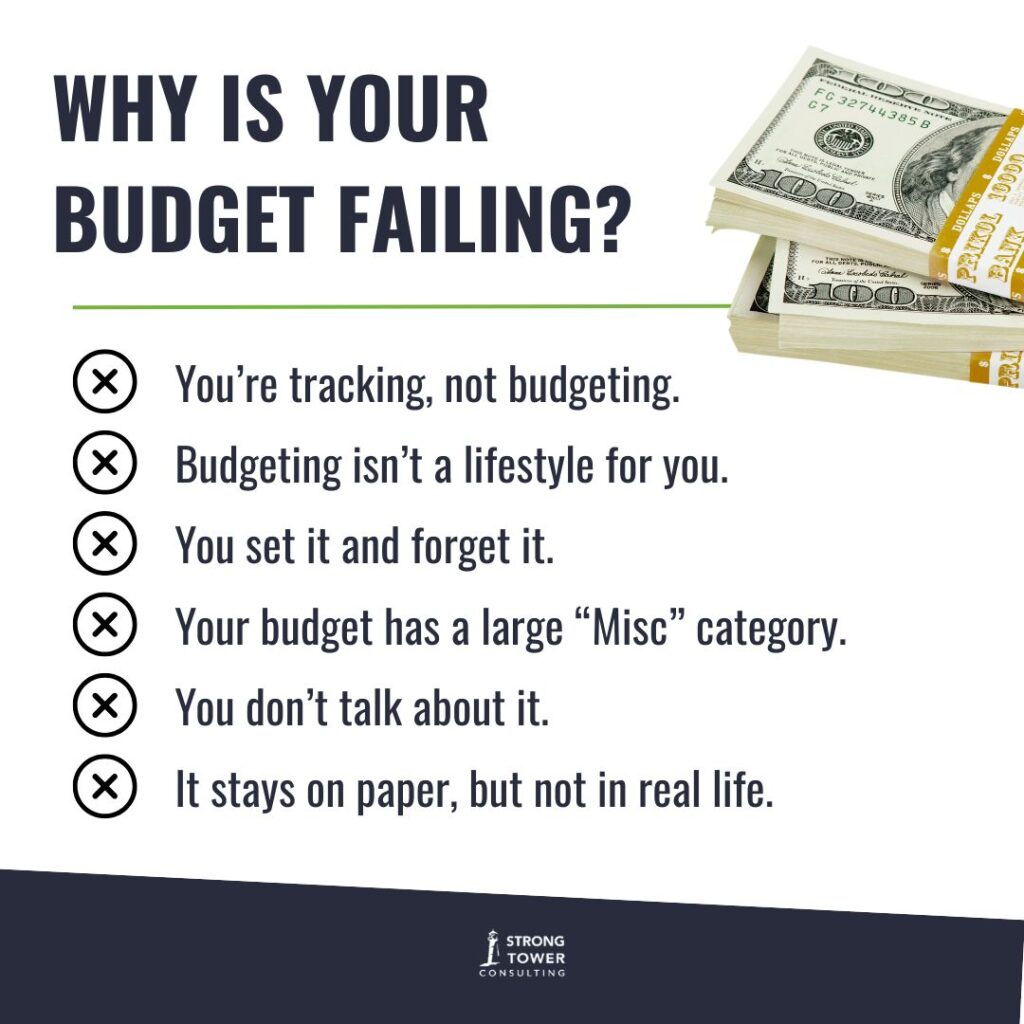

If you’ve ever made a budget only to watch it unravel halfway through the month, you’re not alone. Maybe it looked good on paper, but real life didn’t cooperate. Or maybe you tracked every expense diligently—only to still wonder, “Where did all my money go?”. The truth is, budgeting isn’t just about numbers; it’s about habits, mindset, and execution. And if it hasn’t worked for you in the past, it’s not because you’re bad with money. It’s because most people were never taught how to build a flexible, working budget that fits real life. Let’s break down the common ways budgets go off the rails—and how to finally make a plan that actually sticks.

Why Budgets Fail – And What You Can Do About It

Why Budgets Fail – And What You Can Do About It

You’re tracking, not budgeting.

If you’ve budgeted before and it hasn’t worked, let me ask you: Did you budget or did you log and track your expenses? Tracking your expenses is accounting, not budgeting. Totaling income and expenses at the end of the month is like driving down the highway at 70 mph, but instead of looking ahead through the windshield, you’re looking back through the rear window. If this is how you drive your car, what is going to happen in less than five seconds? You’re going to crash. This is what happens to our finances when we’re only tracking our expenses. We crash. This isn’t budgeting. Budgeting is proactive. You figure out how much everything is going to cost and how you’re going to pay for it before the month starts.

Budgeting isn’t a lifestyle for you.

Maybe you’ve tried budgeting in fits and starts—whenever a big expense hits or motivation strikes—but you haven’t committed to making it a consistent part of your life. Tracking expenses is a start, but it still puts your money in the driver’s seat. Budgeting, on the other hand, is about taking control. It requires ongoing attention and adjustment. It’s not a one-time fix—it’s a lifestyle.

Life isn’t predictable, and neither are your finances. Your income might fluctuate. Unexpected costs pop up. And if spreadsheets alone could solve your money problems, you’d already be set. The truth is, a successful budget isn’t static—it evolves with you. It needs to be flexible, realistic, and centered around your actual goals.

You set it and forget it.

“Set it and forget it” sounds great in theory—but it often falls apart in real life because most people’s expenses and income aren’t the same every month. One month you might have a birthday party, car repair, or higher utility bill. Or maybe your income changes due to hourly work, commissions, or freelance gigs. When your budget is on autopilot, it doesn’t adjust for these variables—and suddenly you’re overspending, dipping into savings, or feeling behind.

Budgeting isn’t a set-it-and-forget-it system. Budgeting needs to be a way of life for the rest of your life. Since life changes regularly, your budget must be updated before each month begins, meaning by March 31, April’s budget should be ready. You actually have to sit and consider April, look at your calendar, recall past annual expenses, project your income, and plan accordingly. Some months, you’ll need to prepare for extra costs, while others bring additional income—like a bonus paycheck or an extra pay period—which also needs a purpose. If your income is irregular, updating your budget becomes even more critical to stay on track. Whether you’re adjusting for more or less than expected, consistently revisiting and refining your budget is key to making it work.

Your budget has a large “Miscellaneous” category.

You’ve written down all your bills and expenses you can think of and you still have money left over in your budget – YAY! “Miscellaneous” can feel like a catch-all category—but if you’ve listed out your bills and usual expenses and still have money left over, don’t celebrate just yet. That leftover amount doesn’t mean your budget is done.

The budget I use is a “zero-based budget,” which means you take your total income and subtract all your budget expense categories to get zero dollars. An expense category is not only for consumer spending, but could be for (a) putting money in savings, (b) paying off debt, or (c) investing in retirement, etc. Your budget balanced to zero is not a bad thing, it’s actually the goal.

A zero-based budget ensures each dollar has a purpose, preventing overspending and false security. For example, if you leave an “extra” $300 unassigned, you might justify small overages in groceries, gas, and shopping—spending that money multiple times without realizing it. A zero-based budget eliminates surprises by assigning each dollar to a category, whether it’s savings, debt payoff, or expenses. (However, this doesn’t mean your bank account should hit zero—you should keep a small buffer of a few hundred dollars untouched.) If expenses exceed income, adjust your spending by reallocating funds or finding extra income and then alter your budget for next month to ensure this doesn’t happen again. While unexpected costs happen, sticking to a budget and making adjustments throughout the month helps you stay in control and avoid last-minute financial stress. And if you need help figuring out those forgotten budget items, go here.

You don’t talk about it.

You create a budget—but then it just sits there. You don’t talk about it. If you’re married, maybe you haven’t brought your spouse into the conversation. If you’re single, you don’t have anyone to help you process decisions or give perspective on whether your spending aligns with your goals. Without input or feedback, it’s easy to miss opportunities to adjust, improve, or stay on track.

If you’re married, both spouses need to be involved in budgeting—not just one making the plan and the other passively agreeing. Money fights are a leading cause of divorce, and a lack of financial communication often signals a lack of communication in other areas. Regular discussions about money foster teamwork rather than resentment. Ideally, hold a weekly budget meeting with your spouse; once you’re comfortable, shift to bi-weekly or monthly check-ins.

For singles, the challenge isn’t communication but accountability. Without a built-in partner to check your spending, it’s easier to overspend or avoid budgeting altogether. Having an accountability partner—whether a friend, mentor, or financial coach—helps you stay on track. I once had a client who wisely set up accountability partners for different aspects of her life. When tempted to book an unbudgeted massage due to stress at work, she asked her financial accountability partner for advice. The simple question, “Is it in the budget?” stopped an impulse purchase that would have overdrawn her account and reminded her a warm bath before bed would do just fine—and wouldn’t cost her a thing. Whether you’re single or married, discussing your budget regularly ensures it’s a living plan, and keeps you in control of your financial future.

It stays on paper, but not in real life.

Maybe you do a good job of writing out a budget—maybe even most months! But as the month goes on, you abandon the plan and start spending on the fly. Unexpected expenses come up, and instead of revisiting the budget to make adjustments, you end up going into debt or pulling money from categories that were meant for something else.

Living out your budget will take some time to get used to. Usually, it’s about three months of trying, adjusting, and trying again, to get the budgeting process down, and close to six months to a year to make it a habit. Don’t get discouraged if the zero-based budget doesn’t work for you the first time (or even the second time).

Budgeting is the most important part of your financial success. No matter how much head knowledge you have about finances or how good you are with a calculator, you won’t win with money until you master budgeting. Set a weekly budget check-in on your calendar—and treat it like a non-negotiable appointment. That one habit will help you catch overspending early, make adjustments in real time, and finally bring your budget to life.

Ready to make budgeting work for you?

These ideas come from a chapter in my book Level Up Your Finances that explores the true purpose of a budget—and how to make it actually work in real life. In that chapter, I walk through the Four Keys to Budgeting that unlock long-term success: Update It, Balance It, Discuss It, and Live It. These aren’t just tips—they’re habits that help transform budgeting from something you try into something that becomes second nature. Grab your copy of Level Up Your Finances today and start turning your money plan into a lifestyle that actually works.

If budgeting has felt inconsistent or overwhelming, you don’t have to figure it out alone. I’d love to help you create a plan that fits your life and actually sticks. Book a free session with me to see how we can make steady, stress-free budgeting a reality in your finances.