Filing taxes—much like going to the doctor—is a task that many of us tend to procrastinate. We know it’s important, we know it’s necessary for our financial health, yet we find ourselves putting it off until the last possible moment. Just like how regular check-ups with your doctor help catch potential health issues early, getting ahead on your taxes can prevent financial headaches down the line.

However, just as delaying a visit to the doctor can exacerbate health issues, procrastinating on filing taxes can lead to a slew of financial headaches and missed opportunities. In this article, we’ll explore why it’s worth prioritizing timely tax preparation and how it can lead to reduced stress, financial security, and a greater sense of control over your financial future. So, let’s dive in and discover the advantages of filing taxes early. Your financial health will thank you for it!

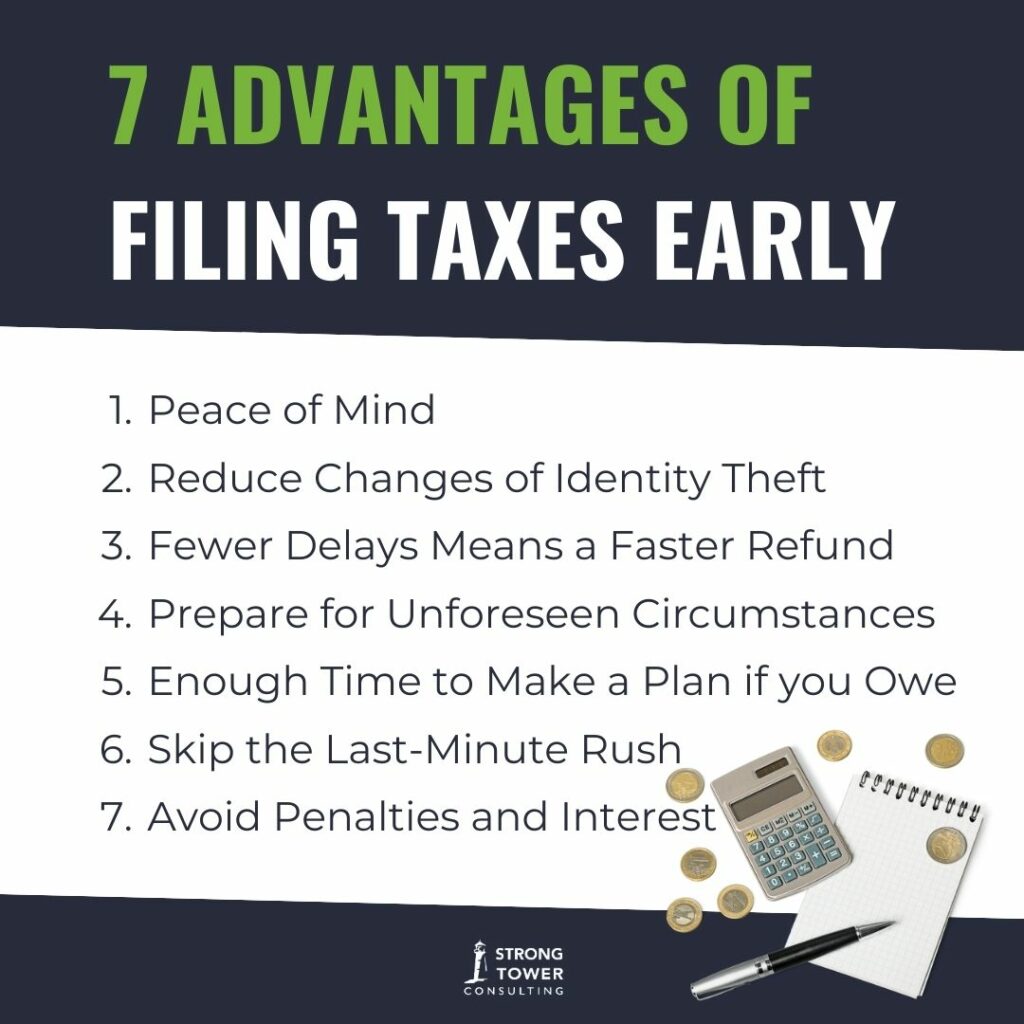

7 Advantages to Filing Taxes Early

-

Peace of Mind

Filing taxes early doesn’t just offer financial benefits—it also provides a profound sense of peace of mind. Picture this: instead of enduring the nail-biting anxiety of impending deadlines and the frantic rush to gather documents at the last minute, early filers can breathe easy knowing that their tax obligations are sorted well ahead of schedule. With taxes out of the way, you can redirect your focus towards pursuing personal and professional goals, nurturing relationships, and other activities that contribute to overall well-being. Sounds much better than stressing out about getting your taxes filed, right?

Moreover, the peace of mind gained from early tax filing serves as a foundation for better financial decision-making throughout the year. Without the looming giant of unfiled taxes hanging over their head, you can approach your personal finances with greater clarity and confidence. Whether it’s setting aside funds for emergencies, saving for future goals, or investing in opportunities for growth, early filers can navigate their financial journey with a sense of empowerment and assurance, knowing that they’ve taken a proactive step towards securing their financial future. In essence, by embracing the practice of filing taxes early, you not only mitigate stress but also lay the groundwork for a more financially stable year.

2. Reduce Chances of Identity Theft

Imagine the relief of finally wrapping up your tax return, clicking that submit button with a sense of accomplishment, only to be met with a gut-wrenching rejection. Your heart sinks as you realize what just happened: someone has beaten you to the punch, using your Social Security number to file a tax return before you could. Suddenly, you find yourself thrust into the unsettling realm of tax refund fraud, a victim of identity theft.

According to the Federal Trade Commission, tax-related identity theft accounted for a staggering 32% of all identity theft reports in 2020 alone. By filing early, you’re significantly reducing the window of opportunity for these criminals to swoop in and file false returns using your personal information. It’s like installing a high-tech security system for your finances, putting up barriers that deter even the most determined thieves. So, take charge of your financial security, beat the swindlers at their own game, and file your taxes early this year. Your financial future will thank you for it!

3. Fewer Delays Means a Faster Refund

Did you know that in 2023, the IRS issued over 90% of tax refunds in less than 21 days for returns filed electronically and with direct deposit? If you weren’t one of the early filers expecting a refund and didn’t file digitally? Well… let’s just say… you would have been waiting awhile (months and months) with the other 2 million plus Americans who filed an untimely paper tax return.

So, by filing your taxes early and digitally, you’re not only getting ahead of the game, but you’re also giving yourself a better chance of getting that refund in your hands faster. The IRS works on a first-come, first-served basis when processing tax refunds. So, if you’re one of the early birds who files their taxes ahead of the crowd, you’ll be first in line to get your refund. That means you could have that extra cash in your pocket sooner than you think!

4. Prepare for Unforeseen Circumstances

Have you ever considered filing your taxes early as a form of financial insurance against life’s unpredictable twists and turns? Let me explain why this practice can be an invaluable asset in preparing for unforeseen circumstances.

Filing taxes early serves as a proactive measure to safeguard yourself against unexpected events that may disrupt your normal routine closer to the deadline. Imagine facing an unforeseen illness, a sudden family emergency, or an urgent demand at work. In such scenarios, having your taxes already filed provides a sense of relief, ensuring that this crucial financial obligation is already addressed.

By taking care of this task ahead of time, you create one less thing to do for yourself, minimizing the impact of unforeseen circumstances on your financial responsibilities. Whether it’s accessing funds for medical expenses, attending to family matters, or managing work-related challenges, early tax filing offers peace of mind and financial stability when you need it most.

5. Enough Time to Make a Plan if you Owe

Did you know that if you file your taxes early and find out you owe money, it’s actually a good thing? Yep, it’s true! Early filers who end up owing money on their taxes have something really valuable on their side: T-I-M-E.

When you file early, you get a head start on figuring out how to handle that bill. Instead of rushing at the last minute, you have plenty of time to make a plan. You can think about where the money will come from, like maybe saving up money each week or asking for extra hours at your job. You can also talk to an advisor you trust for advice on how to manage it. So, filing early doesn’t just help you avoid stress, it also gives you the buffer you need to make necessary changes to pay your tax bill on time – which Uncle Sam appreciates.

6. Skip the Last-Minute Rush

The rush to file taxes as the deadline looms can lead to a myriad of issues, from simple errors in calculations to missing out on potential deductions. By filing early, you can sidestep this chaotic period, allowing ample time for careful review and correction of any mistakes. Moreover, early filers can ensure that they have all the necessary documentation in hand, reducing the risk of overlooking key information or scrambling to gather last-minute paperwork.

Additionally, filing taxes early affords individuals the luxury of avoiding long wait times for assistance from tax professionals or government agencies. As the deadline approaches, these resources become increasingly inundated with questions and requests for support, leading to delays and frustration for those seeking help. By taking proactive steps to file early, taxpayers can access assistance more readily and resolve any issues or questions without the added pressure of looming deadlines. This not only streamlines the process but also minimizes stress and anxiety associated with tax season.

7. Avoid Penalties and Interest

If you wait until the last minute to file your taxes or forget to pay what you owe, the IRS might slap you with penalties and interest fees. But if you file early, you can sidestep all that hassle! By getting your taxes done ahead of time, you ensure you don’t miss the deadline and dodge those additional costs. It’s like being the first one to turn in your homework – you get to kick back while everyone else is frantically trying to catch up! So, filing early not only saves you from stress but also saves you from having to fork over extra cash that could be better spent elsewhere.

According to the IRS, if you file your taxes late, they could hit you with a penalty of 5% of the amount you owe for each month it’s overdue, up to a maximum of 25%. (Did you catch that? Each. Month.) That’s a hefty chunk of change you might end up owing, all because you didn’t get your taxes sorted out on time! By filing early, you make sure you steer clear of those penalties and interest charges. So, when tax season rolls around, remember to get a jump on things and file your taxes early – your wallet will thank you for it!

Filing taxes early isn’t just for the well organized and lovers of paperwork. It offers a myriad of benefits that extend beyond mere administrative convenience. From avoiding the last-minute rush to unlocking financial advantages and strategic opportunities, early filers position themselves for success in navigating the complexities of tax season. By embracing this proactive approach, you can reap the rewards of timely tax preparation, paving the way for financial stability and peace of mind throughout the year.

If you’re still unsure of filing your taxes early and feeling overwhelmed, give me a call.I can help you get in contact with a trusted accountant or help walk you through how to strategically pay your tax bill if you find yourself owing Uncle Sam this year. No matter what, I’m here to help you do well with money and make sure you and your family have a bright future ahead.