January often brings mixed feelings when it comes to money. Credit card statements arrive, bank balances feel heavier, and the pressure to “do better this year” can be overwhelming. Everywhere you look, messages about financial discipline and resolutions push the idea that you’ve fallen short. But here’s the thing: January doesn’t have to be about guilt or shame. Instead, it can be the month you gain clarity about your finances and take control of your money without judgment.

Many people avoid looking at their full financial picture because it feels uncomfortable. Maybe it’s been months since they checked how much debt they carry, or they’ve avoided logging into certain accounts. But awareness isn’t failure. It’s courage. And courage is the first step toward real change. This month is the perfect time to face your money honestly and give yourself a fresh starting point for the year.

January Is the Month of Clarity (Not Guilt)

Clarity Takes Courage

Clarity means seeing your money situation exactly as it is—no exaggeration, no pretending, no wishing it were different. It’s about knowing your income, your bills, your debt, and your spending patterns. Taking this step can feel scary, especially if you’ve avoided it for years. But looking at your finances openly is empowering. It transforms fear into knowledge and uncertainty into action.

When you stop guessing and start observing, you’ll see patterns you may have ignored. Maybe you’ve been surprised by how much convenience spending or small subscriptions add up. That’s normal. Clarity isn’t about judging yourself; it’s about taking responsibility without shame. Once you see the truth, you can start making decisions that actually move you forward.

January Is Not for Fixing Everything

One of the biggest mistakes people make in January is trying to fix everything at once. They create ambitious resolutions to cut expenses by half, save thousands, or pay off all debt in a few months. This approach almost always leads to burnout. The goal for January isn’t perfection – it’s observation.

Start by understanding what’s really happening with your money. Replace assumptions with facts. Even if your budget isn’t perfect, knowing the truth gives you control. This month is about seeing clearly, not doing it all. Observation first, action second. Once you know where your money goes, making confident choices becomes much easier.

Track One Simple Month

The first practical step toward clarity is tracking all of your income and expenses for thirty days. Start by reviewing your paystubs and noticing your net income after deductions, benefits, and taxes. Track everything you spend whether it is a bill, groceries, one-time expense, or debt payment. You can use a simple app, a spreadsheet, or even pen and paper. The goal isn’t to judge or restrict your spending. It’s to see what’s actually happening.

Most people are surprised by what they discover. Small expenses that seem insignificant – subscriptions, convenience foods, or random online purchases often add up faster than we realize. Tracking them brings these “invisible” expenses into the light. Awareness is always the first step before improvement. Once you can see the full picture, you’re in a position to take action instead of reacting blindly.

Writing it Down Brings Relief

The second step is documenting all of your debt. Write down every balance, every minimum payment, and every lender. If you’ve avoided this in the past, it can feel intimidating. That’s normal. But avoiding the numbers doesn’t make them disappear; it only makes them scarier. Once everything is on paper, it becomes something you can manage and plan for.

Many people are surprised at how calming this step can be. Instead of imagining worst-case scenarios, you now know exactly what you’re dealing with. Seeing it all clearly gives you relief because it transforms a guessing game into a manageable plan. Clarity reduces anxiety, even when the numbers aren’t what you hoped for.

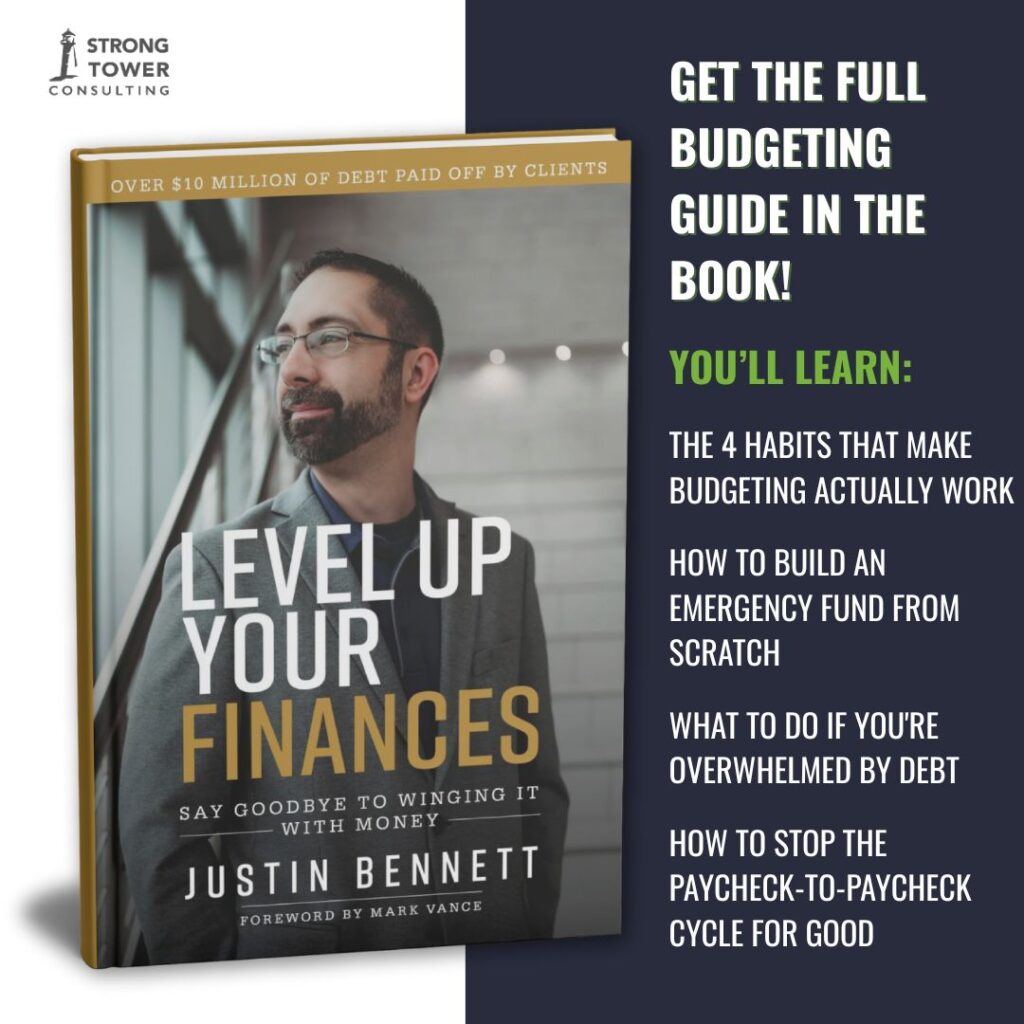

Breaking the Cycle of Regret

As you track spending and write down debt, be aware of guilt sneaking in. Thoughts like, “I should be further along,” or “I shouldn’t have spent that” are common, but they don’t help. This is part of what I call the Cycle of Regret in my book, Level Up Your Finances. It keeps people stuck in avoidance, reactive spending, and ongoing stress.

The good news is that clarity interrupts this cycle. Once you face your money honestly, you stop running from it and start leading it. Progress comes from information, not guilt. Each small step toward understanding is a step away from stress and toward control. And when you break this cycle, even just a little, it changes how you handle all your financial decisions.

Your Next Step Forward

Once you have clarity, building the rest of your financial plan becomes much easier. Budgeting is no longer guesswork – it’s based on reality. You can save intentionally because you know what you’re preparing for. Saying no becomes easier because your priorities are clear. When clarity drives your decisions, money stops being a stressor and starts being a tool.

Clarity also helps you set realistic goals. Whether you want to pay off debt, save for an emergency, or invest for the future, knowing exactly what’s coming in and going out makes those goals achievable. Small wins compound into momentum, and momentum compounds into real financial freedom.

Be Honest, Not Perfect

January is not about creating a perfect budget or a flawless plan. It’s about honesty. Even if your spending is messy or your debt feels overwhelming, documenting it gives you the foundation to improve. A month of clarity is worth far more than a year of wishing.

Start small. Track one month. Write down your debt. Notice patterns. The goal isn’t perfection—it’s control, awareness, and direction. Each small step reduces stress and builds confidence. When you choose honesty over judgment, even tough financial truths become manageable.

Create a Plan With Me Step-By-Step

These steps are the foundation of my book, Level Up Your Finances: Say Goodbye to Winging It With Money. The book walks you through building clarity through awareness, creating a workable budget, and sticking to the principles that will serve you for a lifetime. It’s written for real people with real lives; not idealized budgets or endless willpower.

If you’re ready to stop guessing and start feeling confident with your money, this is a great place to begin. You can also schedule a free financial coaching session with me. We’ll talk through your numbers, your goals, and your next best steps without judgment or pressure. January is a perfect time to take control. Awareness is the first move, and momentum follows later naturally.