The average American graduates college with over $30,000 in student loan debt. Combine that with credit cards, car loans, and other debts, and it’s no wonder many young adults feel overwhelmed by their financial situation. If you’re a recent graduate or just starting out on your financial journey, it’s easy to feel daunted by the mountain of debt or the challenge of managing your money wisely. But here’s the good news: You can take control of your finances and build a secure future for yourself, no matter where you start from.

In this guide, I’ll share ten essential tips that will help you navigate the often confusing world of personal finance. These are practical, proven strategies that can set you on the path to financial success and peace of mind. Whether you’re dealing with debt, trying to save more, or just looking to make smarter money decisions, these tips are for you. So, let’s get started and make your financial future as bright as your potential.

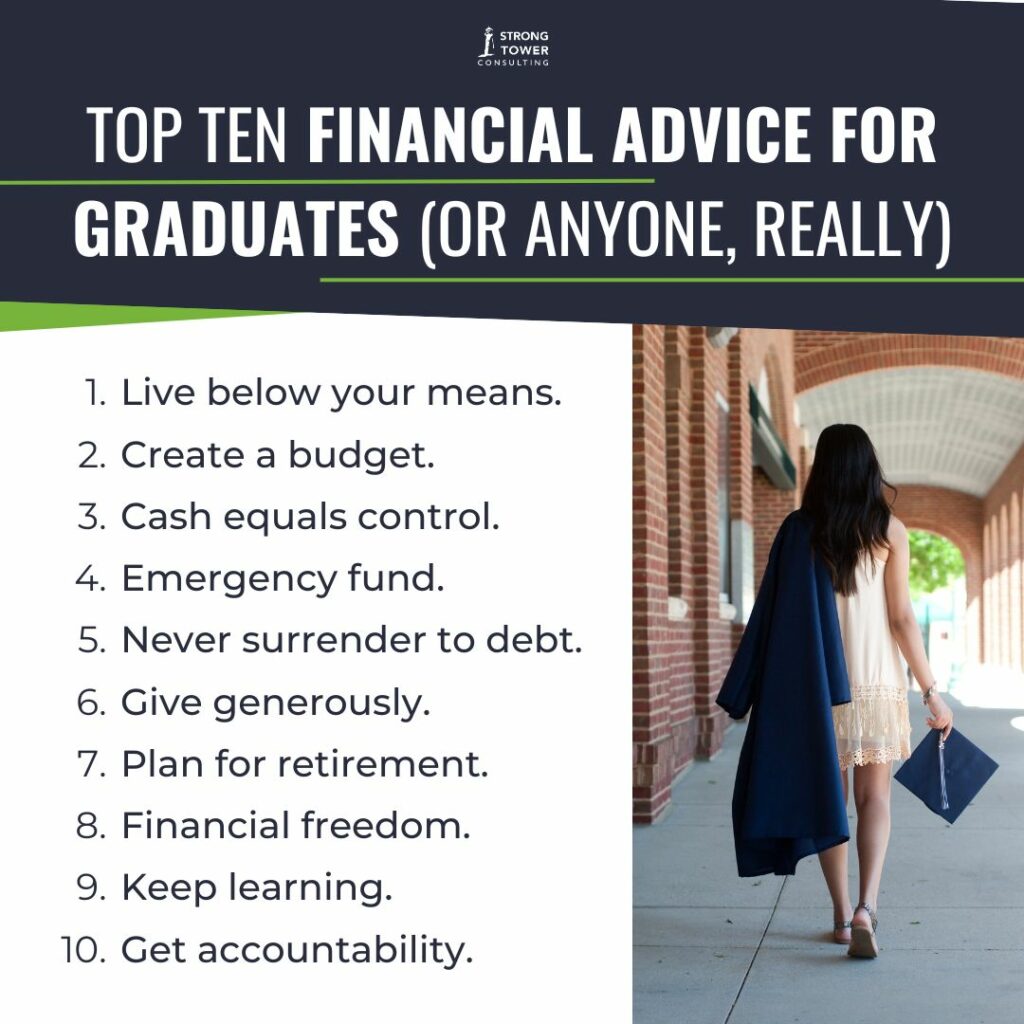

Top Ten Financial Advice for Graduates (Or Anyone, Really)

1. Live Below Your Means

One of the best habits you can develop is living below your means. This simply means spending less than you earn. It sounds simple, but it requires discipline and planning.

When you live below your means, you create breathing room in your budget. This extra money can go towards savings, paying off debt or investments. It also gives you flexibility and reduces financial stress. Take a close look at your expenses and find areas where you can cut back. Maybe it’s eating out less, shopping sales, or finding cheaper alternatives for some of your monthly bills.

2. Create a Budget

Creating a budget might not sound super exciting, but it can really change your financial life. Think of a budget as a map that guides you to your money goals, helping you take control of your finances.

Start by listing all the ways you make money, like your job, commissions, or any side gigs. Next, write down everything you spend money on, including rent, groceries, entertainment, and other household expenses. Make sure your spending doesn’t exceed your income. If it does, adjust your expenses so you have some money left over for the main financial goal you’re working on.

A budget helps you manage your money on purpose, so you’re not left wondering where it all went by the end of the month. By sticking to your budget, you can make sure your money goes toward what really matters to you.

3. Cash Equals Control

There’s something undeniably powerful about using cash for your purchases. When you pay with cash, it makes the act of spending feel more tangible and real compared to swiping a card. You can physically see the money leaving your hands, which can make you more aware of how much you’re spending and what you’re spending it on. This heightened awareness often leads to more thoughtful spending decisions and can help prevent impulsive purchases that can throw off your budget.

Using cash can also help you stick to your budget more effectively. When you have a set amount of cash for things like groceries, entertainment, or dining out, once the cash is gone, you know you’ve reached your limit. It’s a simple yet powerful way to ensure you don’t overspend. Many people find that they spend less when they use cash because they are more conscious of each transaction. This practice not only helps you stay within your budget but also helps you develop better spending habits over time.

When it comes to paying your monthly bills, using a debit card can be a very effective strategy. A debit card offers the same convenience as a credit card—you can pay your bills online, set up automatic payments, and track your expenses easily. However, the key difference is that a debit card uses the money you already have in your bank account, so there’s no risk of falling into debt.

4. Emergency Fund

Life is full of surprises, and not all of them are pleasant. That’s why having an emergency fund is crucial. This fund should cover 3-6 months of living expenses, so you’re prepared for unexpected events like car repairs, medical bills, or even job loss. Having an emergency fund means you won’t have to rely on credit cards or loans when life throws you a curveball.

If you’re still in debt, keep your starter emergency fund at $1,000 until after all your debts are paid. If you want to learn more about why I recommend this, read this article.

Having an emergency fund means you won’t have to rely on credit cards or loans when life throws you a curveball.

5. Never Surrender to Debt

Debt is often described as a heavy chain, and for good reason. It can significantly hinder your ability to reach your financial goals and limit your freedom. Many young adults find themselves burdened with student loans, credit card debt, and car payments, which can quickly add up and feel overwhelming. However, by making a conscious effort to live debt-free, you can enjoy a life of greater financial independence and flexibility. If you’re already in debt, get that cleaned up as fast as possible using the following snowball method.

The Debt Snowball Method

One of the most effective strategies for becoming debt-free is the debt snowball method. This approach involves listing all your debts from smallest to largest, regardless of the interest rate. Start by paying off the smallest debt first while making minimum payments on the others. Once the smallest debt is paid off, move on to the next smallest, and so on.

The debt snowball method works because it leverages psychological momentum. Each time you pay off a debt, you experience a sense of accomplishment and motivation to tackle the next one. Here’s a step-by-step guide to using the debt snowball method:

- List Your Debts: Write down all your debts, from the smallest balance to the largest. Include the creditor, total balance, minimum monthly payment, and interest rate for each.

- Make Minimum Payments: Continue making minimum payments on all your debts except the smallest one.

- Focus on the Smallest Debt: Allocate any extra money you can find in your budget to pay off the smallest debt as quickly as possible. This might mean cutting back on non-essential expenses, picking up a side gig, or selling unused items.

- Celebrate Your Success: When you pay off the smallest debt, celebrate your achievement. This positive reinforcement helps you stay motivated.

- Move to the Next Debt: Take the money you were using to pay off the first debt and apply it to the next smallest debt. Continue this process until all your debts are paid off.

By following the debt snowball method, you’ll not only become debt-free faster but also build the confidence and discipline needed to maintain a debt-free lifestyle.

Living debt-free isn’t always easy, but it’s worth it for the peace of mind and financial freedom it brings. Without the burden of debt, you can allocate more of your income toward savings, investments, and experiences that enrich your life. Additionally, living debt-free reduces stress and anxiety, allowing you to focus on your personal and professional goals.

6. Give Generously

Money isn’t just for spending and saving; it’s also for giving. Cultivating a spirit of generosity can enrich your life in many ways. When you give to others, you’re making a positive impact on your community and the world.

Whether it’s donating to a charity, helping out a friend in need, or supporting a cause you care about, giving makes a difference. Plus, it can bring you a lot of joy and fulfillment. Make giving a regular part of your financial plan, and see how it transforms your perspective on money.

7. Plan for Retirement

Retirement might seem like a long way off, but the earlier you start planning, the better off you’ll be. Start saving for retirement as soon as you can. Investing might sound complicated, but it’s one of the best ways to build wealth over time. The key is to think long-term. Don’t try to get rich quick; instead, focus on steady, consistent growth.

Take advantage of retirement accounts like a 401(k) or an IRA. If your employer offers a match on your 401(k) contributions, be sure to take full advantage of it – that’s free money! Aim to save at least 15% of your income for retirement. It might seem like a lot, but the future you will be thankful.

8. Financial Freedom

Strive for financial freedom. This doesn’t mean being rich; it means taking control of your money, living with intention, and pursuing your dreams without the burden of debt.

Financial freedom comes from knowing you have a plan for your money. It means having an emergency fund, living debt-free, and investing for the future. It’s about making choices that align with your values and goals. When you achieve financial peace, you can live with less stress and more freedom.

9. Keep Learning

Educating yourself on personal finance is one of the most empowering steps you can take to secure your financial future. Continuously learning about personal finance will keep you motivated and equipped to make better decisions regarding saving, spending, and growing your money. Knowledge is power, and in the realm of personal finance, it can mean the difference between living paycheck to paycheck and achieving financial independence.

Start by diving into personal finance books, attending workshops, and following reputable financial blogs and podcasts. Feel free to reach out to me anytime for additional book recommendations, resources, or personal finance advice. I’m here to support you and provide the guidance you need to achieve your financial goals. Together, we can ensure that you stay informed, motivated, and on track to financial success.

10. Get Accountability

We all need a little help sometimes, and having someone to hold you accountable can make a big difference in your financial journey. An accountability partner can be a trusted friend, a supportive family member, or a financial coach like me. This person will help you go over your financial goals and monthly budget, providing guidance and support along the way. They can offer an outside perspective on your spending and saving habits, helping you identify areas where you might need to improve or adjust.

Accountability partners can provide encouragement, offer advice, and help you stay on track. They can also celebrate your successes with you, making the journey more enjoyable and motivating. Sharing your achievements with someone who cares about your progress adds an extra layer of satisfaction. When choosing an accountability partner, it’s important to pick someone who shares your values and understands your financial goals. This ensures that their advice and support will be aligned with what you want to achieve, making their help even more effective.

The Future Is Yours

There you have it – the top ten financial tips for graduates (or anyone, really). These principles are simple, but they’re powerful. Start applying them today, and you’ll be well on your way to a solid financial future. Remember, you don’t have to be perfect. Just keep moving forward, one step at a time. Your financial coach believes in you! Now go out there and make smart choices with your money. You’ve got this!