Fellow friend and financial coach Greg Pare wrote this blog recently that I thought was so inspiring I wanted to share it will all of you.

Fellow friend and financial coach Greg Pare wrote this blog recently that I thought was so inspiring I wanted to share it will all of you.

Recently, a client showed me her envelopes that she had made. Of course, she uses them to separate her cash into her budget categories. Never mind the fact the she and her husband have been working hard for the past 11 months and have managed to pay off $32,000 in debt.

They attribute that to having a plan and the accountability of a financial coach. I say they are focused and on a mission to be debt free!

She mentioned that her two-year old daughter was playing in her purse one night. The daughter took the money out of mom’s envelopes went to her bedroom and put the bills into her toy cash register.

Mom said, “I have never really played store or showed my daughter the money in my purse. I guess she has just been watching me when I make purchases.”

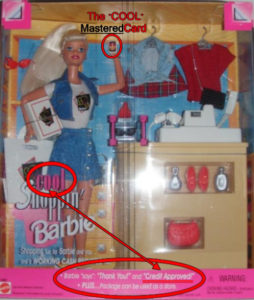

Wow! Talk about a smart two-year old! Of course my comment was that kids are really watching what we adults are doing. It’s the old adage, “Actions speak louder than words.” I went on to tell the parents about the version of Cool Shoppin’ Barbie.

Barbie came with a credit card machine and both a full size and mini credit card. The child could run the card through the machine which announced, “Credit approved.”

Upon hearing my story mom simply stated, “My daughter has never seen me swipe plastic and never will.”

More debt means less options. Less debt means more options when it comes to giving and living. We simply need to teach our kids that, but can’t if we are in debt ourselves. Bust it like this couple is doing. They will be debt free in less than a year.

Their two-year old would much rather prefer Smart Saving and Paying for Cash Barbie. Oh, wait. That one doesn’t exist!

What life lessons have you been taught about money?

What life lessons about money have you taught your children?