Budgeting every month is a great way to avoid financial problems from unexpected expenses and big purchases. Sometimes, things are just more expensive than we can pull off in a month! What if you have to renew your vehicle registration, pay an emergency vet bill, buy an anniversary gift for your spouse, and put down a deposit on a new rental all in the same month? Chances are, your regular income won’t be enough to cover all that and monthly bills.

So . . . what do you do? You make a sinking fund and add it right to your budget with everything else. In this post, I’m going to break down what a sinking fund is, when to use one, and how to use one. Here’s what you need to know:

What is a Sinking Fund?

A sinking fund is a strategic way to save for big expenses you know are coming . . . or you know might come. Instead of simply anticipating big bills and hoping you’ll be able to push money around that month to pay for it, you can actually start saving for it now.

For instance, we all know Christmas is coming up. Whenever you’re reading this post, Christmas is always coming, right? You should be planning for it! Think about how much you want to spend and set your budget now. Then, simply divide that number by 12 (or, if Christmas is only 4 months away, divide it by 4.) Whatever that amounts to is your monthly contribution to your sinking fund!

As long as you budget for that contribution each month, when Christmas arrives, you’ll have all your money for the holiday. No stress! Needless to say, a sinking fund is the best way to save for a big bill.

When Do You Need a Sinking Fund?

Things You Know Will Happen:

- Christmas

- New to You Car

- Upcoming Surgerys/Procedures

- New Baby

- Wedding

- Travel/Vacations

- Birthdays

- School Supplies

- Clothes

- Home Remodels

- Annual Bills

- Tuition

- Seasonal Maintenance

- Regular Vehicle Maintenance

Things You Know Could Happen:

- Car Repairs

- Home Repairs

- Doctor Bills

- Vet Bills

- Appliance Repairs

- Tax Increases

- Disasters (Tornado, Hurricane, Flood, etc.)

Is it the Same as an Emergency Fund or Savings Account?

A sinking fund isn’t the same as an emergency fund or savings account. A savings account/emergency fund is supposed to be kept for, of course, emergencies. However, if you can limit the amount of “emergencies” you have by planning for common unexpected expenses in your sinking fund, your savings account is that much more useful and secure!

Sinking funds will keep your savings organized and when a sinking fund is used in-addition to an emergency account, your family is very well protected from upcoming circumstances. You’re ready for almost anything!

Where Do You Put a Sinking Fund?

We don’t recommend separate accounts for all of your sinking funds. That’s way too tedious. Instead, take out cash and put your contribution into a designated envelope. Of course, you should then store that envelope in a secure place.

If you’re more digital, you can keep track of sinking funds using a budgeting app like EveryDollar, a budgeting bank account like Qube, or a budgeting Excel sheet like the one I use with my clients. Do whatever works best with your current budgeting system!

What are the Benefits of a Sinking Fund?

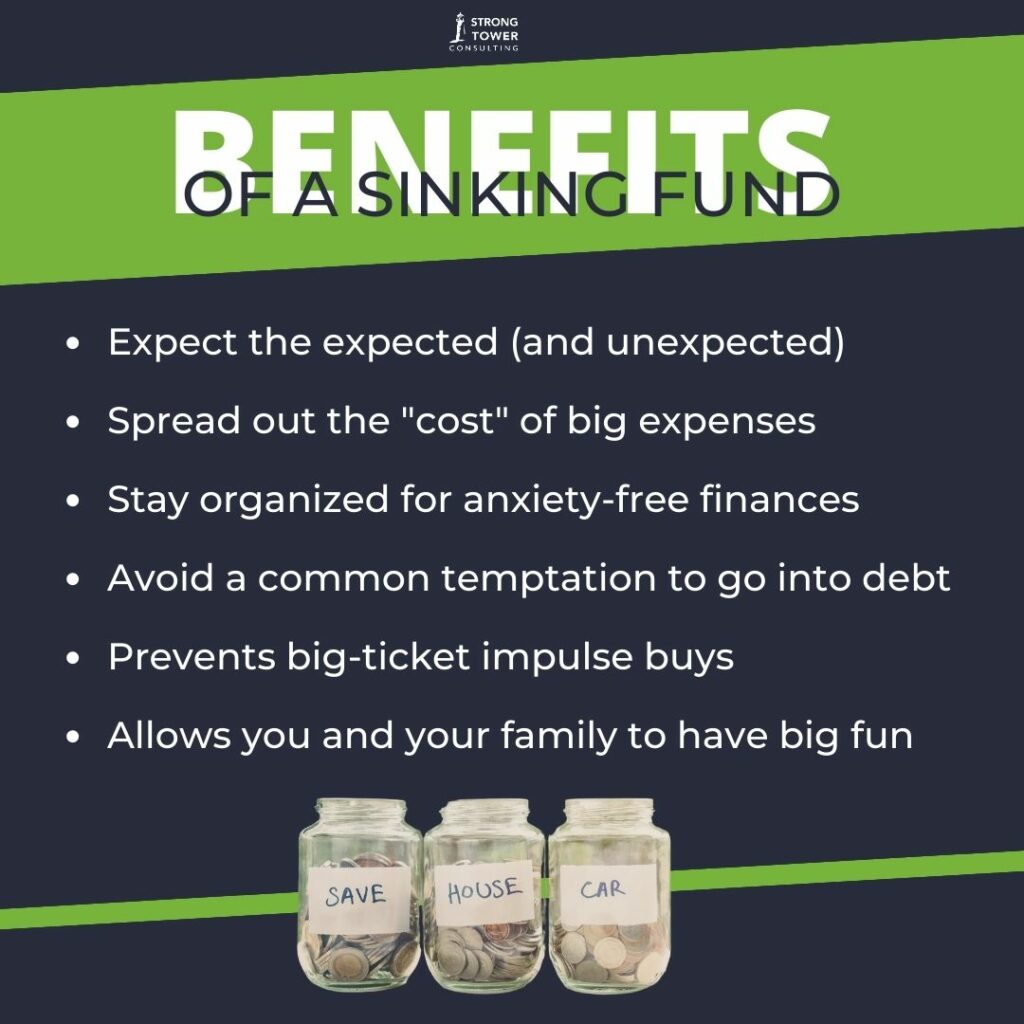

Expect the expected (and unexpected.)

If you already know a big expense is coming up, you should plan for it! Knowing that your kids need school supplies in August shouldn’t stress you out, it should give you peace that you can plan and budget before you need to swipe your card. A sinking fund is the key to planning for big bills you know are coming up.

Also, what is the main reason your budget gets thrown off? Unexpected expenses! If you can anticipate the unexpected, you can prevent a potential budget-breaking moment that sends you back into old habits. Things like car repairs and medical bills are inevitable. You know they’ll happen, you just don’t know when. Plan for it now, so it doesn’t break the bank later.

Spread out the “cost” of big expenses.

If you need to purchase something like another car, a new appliance, furniture, school tuition, or a medical procedure, you can use a sinking fund to pay the bill a little a time.

Think of it as credit in reverse. You save now and pay later! (That’s the way it should be anyway.) A scheduled and budgeted sinking fund makes saving the money for big expenses much easier.

Stay organized for anxiety-free finances.

There’s nothing worse than the ambient stress of all the financial “what ifs.” What if our one car needs fixed? What if that plumbing issue worsens? Or, what if someone in my family gets hurt? These things spin around in our minds all the time, causing stress and panic. However, when you have a sinking fund, your anxiety can go away! You have money to cover those “what ifs.”

Avoid a common temptation to go into debt.

You probably won’t be tempted to go into more debt when things are going well in your financial world. No, you’ll be tempted to fall back into old ways when something goes wrong—when you need to pay for braces, when the dryer goes out, or when the dog breaks a bone. It’s in these moments you’ll think about pulling out the credit card or calling the bank.

But, if you have a sinking fund, what’s the temptation? You already have the money to cover it. A sinking fund can be one of the best ways to keep you from falling back into bad habits.

Prevents big-ticket impulse buys.

A sinking fund also forces you to slow down. If you find yourself swayed by the release of a new gaming system or the shininess of a new espresso machine, a sinking fund for these for-fun expenses can help you stop and think before you buy.

Instead of grabbing that item the minute you want it, you save for a few months and then make the purchase—by that time, maybe you don’t even want it anymore or the price has even come down. Either way, with a sinking fund, you’ll have no buyer’s remorse!

Allows you and your family to have big fun.

I’ll never forget a family I was working with who went on vacation with credit cards despite my instruction. They insisted that they deserved a break and went regardless of my advice. When they came back for their next session, they did not look well-rested or even very happy. It turns out; they didn’t enjoy the trip at all, because the guilt and stress of money was there the whole time.

With a sinking fund, you can put away money for your next family vacation or for-fun purchase. When you finally pay for this expense and play with your new toy or travel to your new destination, you’ll truly be able to sit back, relax, and enjoy your time. Why? Because it’s paid for!

Sinking funds are the perfect way to stay on budget and pay for big expenses!

Sometimes you know what life will throw at you, and sometimes you don’t! A sinking fund can be a big help in preparing for financial challenges, big and small. So, sit down and think about big upcoming expenses and start a few sinking funds! You won’t regret it!

For more budgeting help and financial advice, schedule a free call with me! And, for quick tips and guides, check out the blog for the latest wisdom on all things money. No matter what your financial needs are, Strong Tower Consulting is here to help out!