Over 70 million people, or roughly 45% of working Americans, are working side hustles. Of those people, 41% say they’re doing it because they need extra income for living expenses. WOW! That’s a lot of people who are short on cash at the end of the month.

We’re all feeling this hit, though, aren’t we? Inflation is at a record high and wages aren’t increasing at the same rate. Other reasons people listed for working a side job were boosting savings and paying down debt, which are both great goals that can be difficult on one income.

If you find yourself in need of some extra money, how do you get it? Why should you do it? What side gig would fit you best and have the highest income potential? That’s what I’m exploring with you today! I’ll walk you through how to find the perfect side gig and give you some great examples. Here’s how it’s done:

How to Find the Perfect Side Gig to Make Extra Money

Benefits of Having a Side Hustle

As I mentioned, there are several reasons people start side gigs. Below, I’ll list some benefits of having a side hustle so you can determine if an extra job is the right fit for you. Plus, you can start forming your “why.” All these benefits will keep you motivated even when working extra is running you down. This is what you gain from a side hustle:

- Make more to pay off debt

- Build savings faster

- Make more money to pay for monthly expenses

- Use extra income to give back to the community or charity

- Spend time working in your true passion

- Work toward becoming your own boss

- Use free time in a more productive way

- Explore your skills, talents, and future goals

- Gain confidence and build your resume for a career change

- Network to find more opportunities

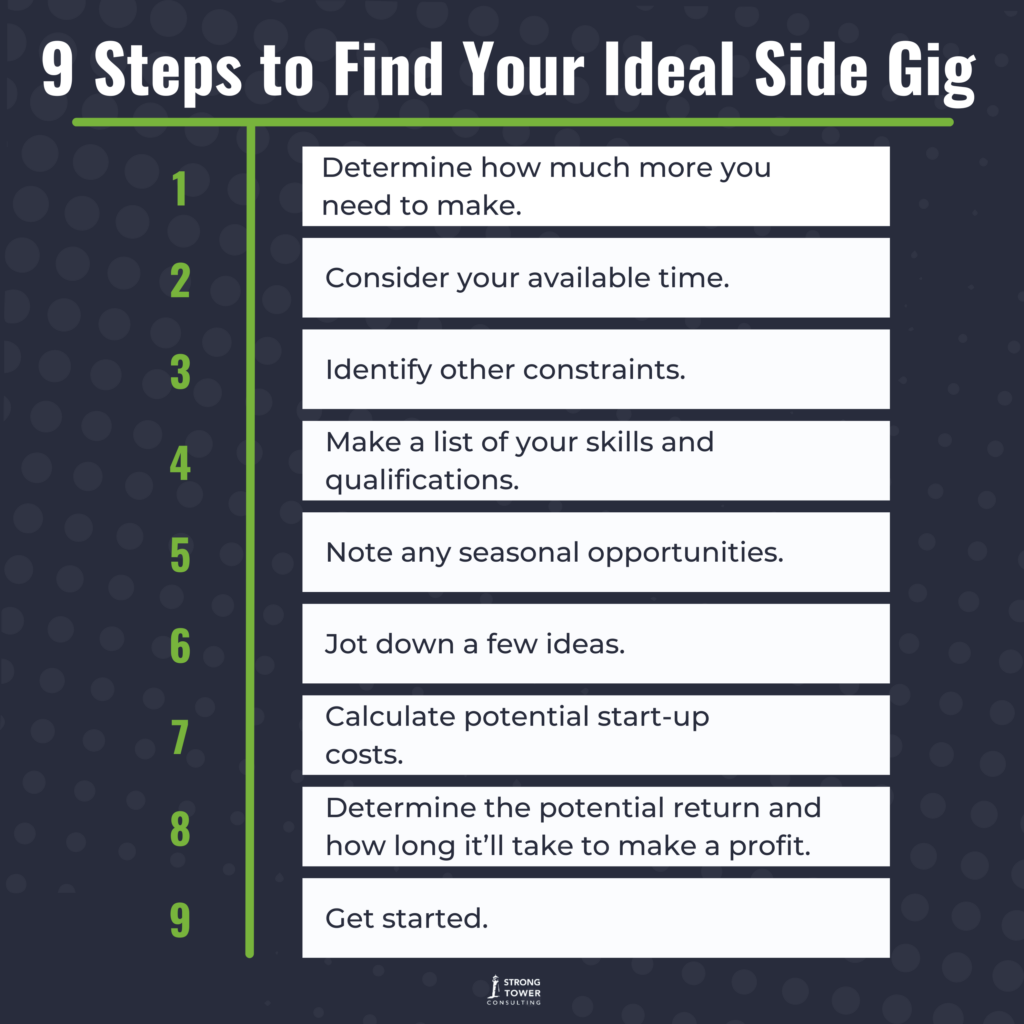

9 Steps to Find Your Ideal Side Gig

Now that you know how a side gig will help you, let’s figure out what kind of work would be best for you. The goal is to find something both lucrative and enjoyable! The latter might vary in importance depending on how badly you need some cash, but let’s work through that below. Here’s a step-by-step guide to finding your ideal side gig:

Determine how much more you need to make.

First up, how much more do you need to make? Are you simply trying to earn enough money to pay for a small car repair? Or, do you need a big chunk of change to help you tackle your debt snowball?

Knowing this is important, because it’ll determine whether you should think about making a whole side business or if you just need odd jobs for a short season.

Consider your available time.

How much time you have is definitely something to consider when choosing a side hustle! Something like event planning or flipping furniture can be really time-consuming. If you don’t have those kinds of hours in the day, renting out your car or selling a digital product might be a better option! Note how much time you have, and let that guide your next steps to finding a side gig.

Identify other constraints.

What other constraints do you have? Maybe you have children, so whatever you do needs to either involve them or happen in the home. If that’s the case, cross ridesharing or starting a handyman business off your list! Other constraints might be no transportation, an on-call full-time job, or health issues. Jot all these down to help you narrow down your ideas.

Make a list of your skills and qualifications.

What are you really good at? You can list things like work experience and certifications, but don’t forget about your hobbies! Are you a great baker or cook? Do you make really amazing handmade decor? Are you a long-time pet owner/lover? All these things could translate to side gigs! Think beyond your job, and write down ALL the things you’re great at.

Note any seasonal opportunities.

Every season provides its own opportunities. In the summer, you could mow and weed yards. Around the holidays you could cater meals, bake goods, or wrap gifts! In the spring, you could help with deep cleaning, planting gardens, and doing home renovations. And, those are just a handful of ideas! Determine what specific opportunities you can take advantage of in this season.

Jot down a few ideas.

Hopefully, this got your creative juices flowing! Jot down a few potential side gigs you now have in your head. Make sure they all fit within the parameters above. You must already have the skill, it needs to make the right amount of money, and it needs to fit within your lifestyle constraints. We’re almost there!

Calculate potential start-up costs.

Now that you have a few ideas, what are the start-up costs for each? Take time to research each one. Be realistic, but don’t go overboard either. If you already have an SUV or pickup, you don’t NEED a new truck to help people move. And, no, you don’t need to get a $3,000 camera to start a photography business. Keep it all reasonable!

After you determine the cost, ask yourself if that’s feasible with your current income and savings. Definitely don’t dip into your emergency fund to do this! If your available funds to start are $0, then that’s all you have to work with. Don’t go into debt hoping for a big ROI.

Determine the potential return and how long it’ll take to make a profit.

Next, how long will it take you to make a return on your investment for these job options? Will you be able to book a gig and start right away? Or, will it take time to grow a following, make the product, develop the program, or sell an item?

Once you know how long it’ll take, ask yourself if you have that kind of time. If you want this money to pay off debt, boost savings, or have some for-fun money, then being a few months from a profit is fine. However, if you need to pay an overdue bill or get groceries, this money has to come ASAP.

Get started.

Finally, pick a job! Which ones are left standing? Choose the one that’ll bring you the most joy and the most income. Then, start creating your plan, collecting resources, and marketing your new gig. If you’re still coming up with ideas, I’ve added a few below:

25 Side Gigs to Build Your Income

- Make and sell something.

- Do landscaping tasks.

- Cater parties and events.

- Freelance write or design.

- Become a digital assistant.

- Use a rideshare or delivery app.

- Walk dogs.

- House sit, pet sit, or babysit.

- Wash cars.

- Clean houses.

- Tutor.

- Rent out a room in your house.

- Rent out your car.

- Buy items from thrift stores and garage sales to resell.

- Help people move.

- Become a handyman.

- Donate blood and plasma.

- Affiliate market through blog or social media page.

- Become an event planner.

- Provide any service in your realm of expertise.

- Teach about something you know.

- Start a photography business.

- Sell art or photography.

- Flip furniture.

- Get a low stress part-time job.

A side gig is a great way to build savings, pay off debt, and create margin in your budget.

I’m all for side hustles. They help you add margin to your budget and achieve your financial goals. A lot of times, these side gigs even turn into full-time business that people are more passionate about than their 9-5, which is AWESOME. I love to see individuals successfully doing what they love!

So, make a business plan and get to work. Just like all the other income, ensure your budgeting every dollar that comes in. This way, you know the money isn’t just going down the drain, but it’s actually supporting your money goals. If budgeting, financial goals, and all the money stuff is over your head, and you don’t know where to start, grab a free session with me. I am a financial coach, ready to help you create a lucrative and peaceful financial future!