Unexpected home repairs can significantly strain even the most carefully planned budgets, turning what should be a sanctuary into a source of financial stress. From a leaking roof to a failing HVAC system, these unanticipated expenses can quickly add up, leaving homeowners scrambling for solutions. However, with proper planning and preventive measures, you can manage these costs effectively and avoid breaking the bank. By implementing strategic approaches such as building an emergency fund, scheduling regular maintenance, and making informed decisions on repairs and upgrades, you can protect your home and your finances.

Preventing home repairs from becoming budget busters requires a proactive mindset and a commitment to regular upkeep. Homeownership involves more than just making mortgage payments; it also includes ongoing maintenance to ensure your home remains safe, efficient, and comfortable. Understanding common costly repairs and how to prevent them can save you from financial headaches down the line. This article will explore practical tips and strategies to help you manage and mitigate the costs of home repairs, enabling you to maintain a healthy and stable budget while safeguarding your investment.

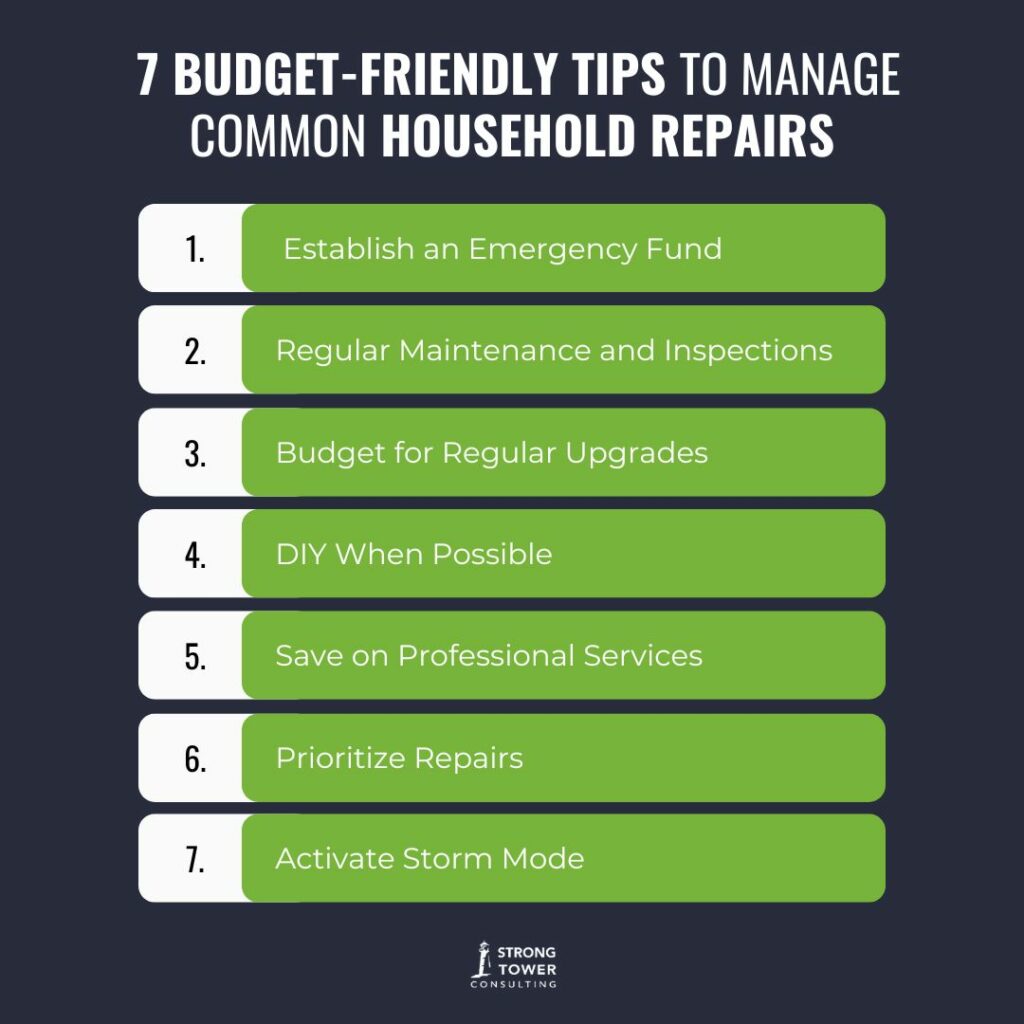

Seven Budget-Friendly Tips to Manage Common Household Repairs

-

Establish an Emergency Fund

Having an emergency fund is essential for financial security, particularly when unexpected home repairs arise. An emergency fund acts as a safety net, ensuring you have the funds available to cover significant repair costs without disrupting your regular budget. To build this fund, start by setting aside a small portion of your income each month until you accumulate three to six months’ worth of living expenses. This gradual approach makes it manageable to save, and having this reserve will provide peace of mind and financial stability when faced with urgent home repairs.

-

Regular Maintenance and Inspections

Regular maintenance and inspections are essential for keeping your home in good condition and avoiding costly repairs. By scheduling annual inspections of critical systems such as the roof, HVAC, plumbing, and electrical systems, you can proactively identify potential issues before they escalate. Inspections allow you to detect minor leaks, cracks, or wear and tear early on, preventing them from developing into more significant problems that require extensive repairs.

Routine maintenance tasks such as cleaning gutters, checking seals around windows and doors, and servicing appliances like water heaters or HVAC units help ensure optimal performance and longevity. Investing time and resources in regular maintenance not only extends the lifespan of your home’s components but also saves you money by addressing issues when they are smaller and less expensive to fix.

-

Budget for Regular Upgrades

Gradually upgrading home systems and appliances can help spread out costs and prevent sudden large expenses. Allocate a portion of your monthly budget specifically for home improvements in a sinking fund, focusing on areas that are likely to need attention in the near future. By planning and saving for these upgrades, you can avoid the financial strain of dealing with multiple repairs at once. Regularly updating systems like plumbing, electrical, and HVAC not only improves your home’s efficiency and safety but also enhances its value and reduces the likelihood of emergency repairs.

It’s generally recommended to save about 1% of your home’s value each year for repairs and maintenance. This guideline helps homeowners prepare for both routine upkeep and unexpected repairs. For instance, if your home is valued at $300,000, you should aim to set aside $3,000 annually. By consistently setting aside this amount, homeowners can build a reserve fund that mitigates the financial impact of significant repairs, ensuring that they are prepared to handle maintenance needs without disrupting their overall budget.

-

DIY When Possible

Taking on do-it-yourself (DIY) projects for minor home repairs can significantly reduce costs and prevent them from becoming budget busters. Many simple repairs and improvements around the house, such as painting, replacing hardware, or fixing minor plumbing leaks, can be completed with basic tools and a bit of research. DIY projects not only save on labor costs but also empower homeowners to learn valuable skills and gain a deeper understanding of their home’s systems.

However, it’s essential to recognize your limitations and know when a project may require professional expertise. For more complex or potentially hazardous tasks like electrical work or major plumbing repairs, hiring a qualified professional ensures safety and ensures the job is done correctly, preventing costly mistakes that could arise from DIY attempts gone wrong.

-

Save on Professional Services

When professional services are necessary for home repairs, there are several strategies to help manage costs effectively. Start by obtaining multiple quotes from reputable contractors to compare prices and services offered. Don’t hesitate to negotiate prices or ask for discounts, especially when bundling multiple repairs into a single service call. Many contractors are willing to work with homeowners on pricing, particularly for larger or ongoing projects.

Keep an eye out for seasonal promotions, coupons, or referral discounts offered by service providers. Building a positive relationship with reliable contractors can also lead to better pricing and peace of mind knowing that the work will be done competently. By being proactive in researching and selecting service providers, you can minimize expenses while ensuring quality repairs that safeguard your home and budget.

-

Prioritize Repairs

Addressing home repairs in order of priority is crucial to preventing them from becoming budget busters. Start by identifying and tackling issues that pose immediate risks to safety or could lead to significant damage if left unresolved. This includes problems such as roof leaks, electrical faults, or plumbing issues that could cause water damage. By prioritizing these critical repairs, you can prevent the situation from worsening and avoid more costly fixes down the road.

Once urgent repairs are addressed, you can then create a plan to gradually handle less critical maintenance tasks and improvements. This systematic approach not only protects your home’s structural integrity but also helps you manage repair costs efficiently over time. Regularly reassessing and updating your repair priorities ensures that you stay ahead of potential issues and maintain a healthy home environment without breaking your budget.

-

Activate Storm Mode

“Storm mode” refers to a financial strategy where individuals or households prioritize saving money aggressively and quickly to build up a substantial cash reserve when the required funds aren’t already in the emergency and home maintenance funds. This approach is typically adopted when there is a known impending expense, such as the need to replace an aging roof or HVAC system. The term “storm” symbolizes the urgency and intensity of quickly saving money, similar to preparing for a storm by securing everything tightly.

During storm mode, individuals may temporarily cut back on discretionary spending and focus on funneling as much income as possible into savings. This might involve reducing expenses like dining out, entertainment, or non-essential purchases. The goal is to accumulate a significant amount of cash within a relatively short period, ensuring that when the anticipated expense arises, there are sufficient funds available to cover it without resorting to borrowing or disrupting long-term financial goals.

Secure Your Home and Budget

Taking proactive steps to prevent home repairs from becoming budget busters not only protects your financial well-being but also preserves the comfort and value of your home. By implementing strategies such as building an emergency fund, scheduling regular maintenance, and making informed decisions about repairs and upgrades, you can mitigate the impact of unexpected expenses. Remember, preparation is key to maintaining a stable budget and ensuring your home remains a haven for years to come. If you’d like personalized guidance on managing household finances or preparing for major home repairs, consider signing up for a free coaching session with me. Take the first step toward financial security and peace of mind today.