Numbers alone will never keep you motivated. A budget without meaning is just a spreadsheet—and spreadsheets don’t change lives. They can show you where your money is going, but they don’t tell you why it matters or inspire you to stick with it when temptations or setbacks arise. What truly changes lives are principles—clear, guiding truths that act as a compass for your money, showing each dollar where it should go and why. When you define your principles first, every financial decision becomes easier, because you’re no longer relying on willpower or fleeting motivation—you’re relying on a framework that reflects what matters most to you. By starting with what matters most, your financial plan becomes more than numbers; it becomes a roadmap to a life aligned with your values, one intentional choice at a time. Here’s how to choose principles that give your money purpose and help you stay on track, even when life gets messy.

Giving Money Meaning

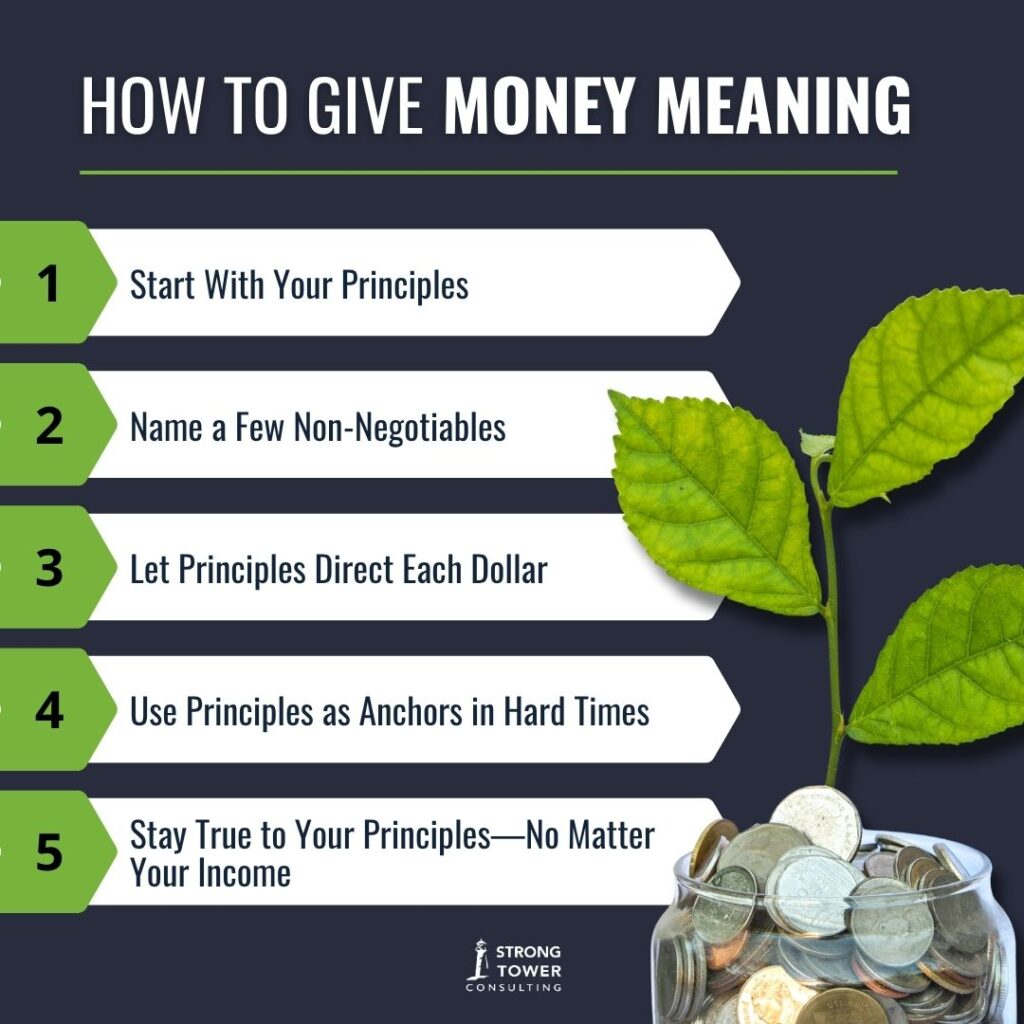

1. Start With Your Principles

Before you talk numbers, talk about what matters most. Do you want to be more generous? Build a stable home for your kids? Travel freely? Retire early? Your principles should reflect the deeper priorities you want your money to serve, the things that give your life meaning and direction. Studies have shown that the more we align our core values and principles, the more likely we are to benefit from our goal plans (Erez, 1986).

Think of it this way: if someone looked closely at how you spend, save, and give, what story would your financial choices tell about your priorities? Are they in sync with your values, or do they tell a story of impulsive choices, scattered goals, or unmet intentions? When your spending and saving patterns don’t reflect your heart, it’s a clear signal that it’s time to rewrite the story—to make your money an intentional extension of what you care about most.

2. Name a Few Non-Negotiables

Principles work best when they’re simple and memorable. Aim for three to five short statements that describe how you handle money, like:

- “Give first, live on the rest.”

- “Spend less than I earn.”

- “No new debt—ever.”

- “God owns it all.”

These aren’t just slogans; they’re decision filters. When you face a purchase or a big financial choice, you can measure it against these non-negotiables. Otherwise, you’ll find yourself wondering how a “quick trip to Target” turned into a $200 adventure in throw pillows you didn’t know you needed. If a purchase doesn’t align with your plan or principles, the decision is already made for you—it’s a no. No guilt. No second-guessing. You’re not depriving yourself; you’re simply staying true to the boundaries you set to protect your bigger goals.

3. Let Principles Direct Each Dollar

Once your principles are clearly defined, your budget becomes the best tool to put them into action. Think of your budget as a map, guiding each dollar toward what matters most, rather than letting money drift wherever temptation or impulse leads. Principles act as the compass, and your budget is the route that ensures each decision stays on course.

For example, if one of your principles is generosity, “giving” becomes a dedicated, prioritized line in your budget—not something left over if there’s money left at the end of the month. If another principle is “live below our means,” your spending limits naturally reflect that value, creating space for savings, margin, and unexpected expenses. A principle like “I will live debt-free” influences even the biggest choices, from the home you purchase to how you plan vacations, making sure your dollars support long-term stability instead of short-term gratification.

Using a budget this way takes the emotion out of money decisions. Instead of asking, “Do I feel like saving or saying no this month?” you ask, “Does this align with my principles?” Your budget becomes a tool that enforces that alignment, providing clarity and confidence when temptation strikes. Over time, these principle-driven allocations compound, helping you build a life—and a financial future—that truly reflects what matters most to you.

4. Use Principles as Anchors in Hard Times

Life is unpredictable. Cars break down. Jobs change. Kids outgrow their shoes overnight. When emergencies or setbacks happen, principles keep you steady. Instead of reacting out of fear or impulse, you can fall back on the values you’ve already decided matter most, giving you a clear path forward even when circumstances feel chaotic.

But it’s not only emergencies that can derail your plans. I’ll never forget when my wife and I were climbing out of debt with a fledgling business, repeatedly saying “no” to things so we could honor our value of getting out—and staying out—of debt. One evening, we were at a favorite local restaurant celebrating our daughter’s birthday. She spied one of her favorite appetizers on the menu—cheeseballs—and wanted them badly. The golden frying smell filled the air, emotions were high, and it would have been easy to give in. But we stuck to our budget for the celebratory meal, declining the cheeseballs while still enjoying ice cream that was within our plan. That single choice didn’t cripple us financially, but giving in could have set a pattern that would slowly undermine our progress.

Principles like these serve as more than guidelines—they shape the way you handle every financial decision. For example, if your principle is “no new debt,” you’ll naturally look for creative ways to cover an expense—selling something, picking up a side hustle—rather than swiping a credit card. Your principles give you the courage and clarity to stick to the long-term plan, even when the short-term feels shaky or tempting.

5. Stay True to Your Principles—No Matter Your Income

Getting out of debt or hitting a big savings goal doesn’t mean your principles expire. The same habits and values that helped you climb out of debt—living on a budget, working diligently, saving intentionally—are the ones that will keep you free. In fact, these principles aren’t just a means to an end; they’re the foundation for everything that comes next.

Imagine a tree where the roots represent your deepest values—things like security, generosity, faith, or family. These roots feed into a strong trunk of principles and behaviors, like budgeting, saving, and giving wisely, which in turn support the branches—your specific goals, such as buying a home, paying off debt, or traveling. At the ends of the branches grow the leaves and fruits, the outcomes you hope for: financial freedom, confidence, and joy. Just like a tree, your goals only thrive and bear lasting fruit when they are firmly rooted in your values.

Wealth opens the door to new opportunities, offering freedom, choice, and the ability to create the life you’ve envisioned. But with these opportunities come new temptations—larger purchases, lifestyle upgrades, and the pressure to “keep up” can quietly erode your progress. Staying anchored in the principles and habits that got you here—discipline, intentionality, and wise decision-making—acts like a compass, keeping you on course and protecting you from drifting back into financial stress. It prevents you from repeating old patterns and falling back into the cycle of regret, helping you not only preserve your wealth but also use it in ways that align with your values and long-term goals. By holding fast to these guiding principles, your financial growth becomes sustainable, intentional, and genuinely rewarding.

The Bottom Line

A budget without principles is just math—a list of numbers that tells you what’s coming in and going out, but says nothing about why it matters. When your budget is rooted in clear, personal values, it transforms into a roadmap for the life you truly want—a tool that helps you make intentional choices, prioritize what matters most, and create space for the things that bring meaning and joy.

If you’re ready to move beyond spreadsheets and give your money a deeper purpose, start by identifying your guiding principles today, and make it a habit to revisit them often. Need a practical guide to turn these ideas into action? My book, Level Up Your Finances, walks you step by step through building a plan that reflects your values, helping you stay aligned with your goals and move steadily toward financial freedom—one intentional, meaningful decision at a time.