Most couples don’t struggle with money because they are bad with numbers. They struggle because they are winging it. Bills get paid when someone remembers. Spending happens without much planning. One person worries while the other avoids the conversation altogether.

Instead of bringing you together, money slowly becomes another source of stress. Arguments pop up. Resentment builds. Over time, it can hurt your relationship, your future plans, and even your financial security. If you don’t get on the same page, big goals like buying a home, paying off debt, or saving for your family’s future can feel out of reach.

If you’ve ever wondered where your money keeps going, or felt frustrated because you and your spouse are not on the same page, you are not alone. Learning how to budget together is not about control. It is about clarity. And clarity creates peace.

How to Budget Together as a Couple

Why Winging It With Money Does Not Work

When couples wing it with money, they rely on hope. They hope there is enough in the account. They hope the bills clear. They hope nothing unexpected happens that month.

But hope is not a system. Without a plan, money tends to disappear quietly. A few extra meals out, forgotten subscriptions, or unplanned purchases slowly add up. Then a larger expense appears, such as car repairs or holiday spending, and everything suddenly feels overwhelming.

After seeing why winging it with money creates stress, the next step is simple. You do not need a complicated system or a perfect plan to begin. You just need a place to start. That place is your budget tool. A budget gives your money direction before life pulls it in every direction.

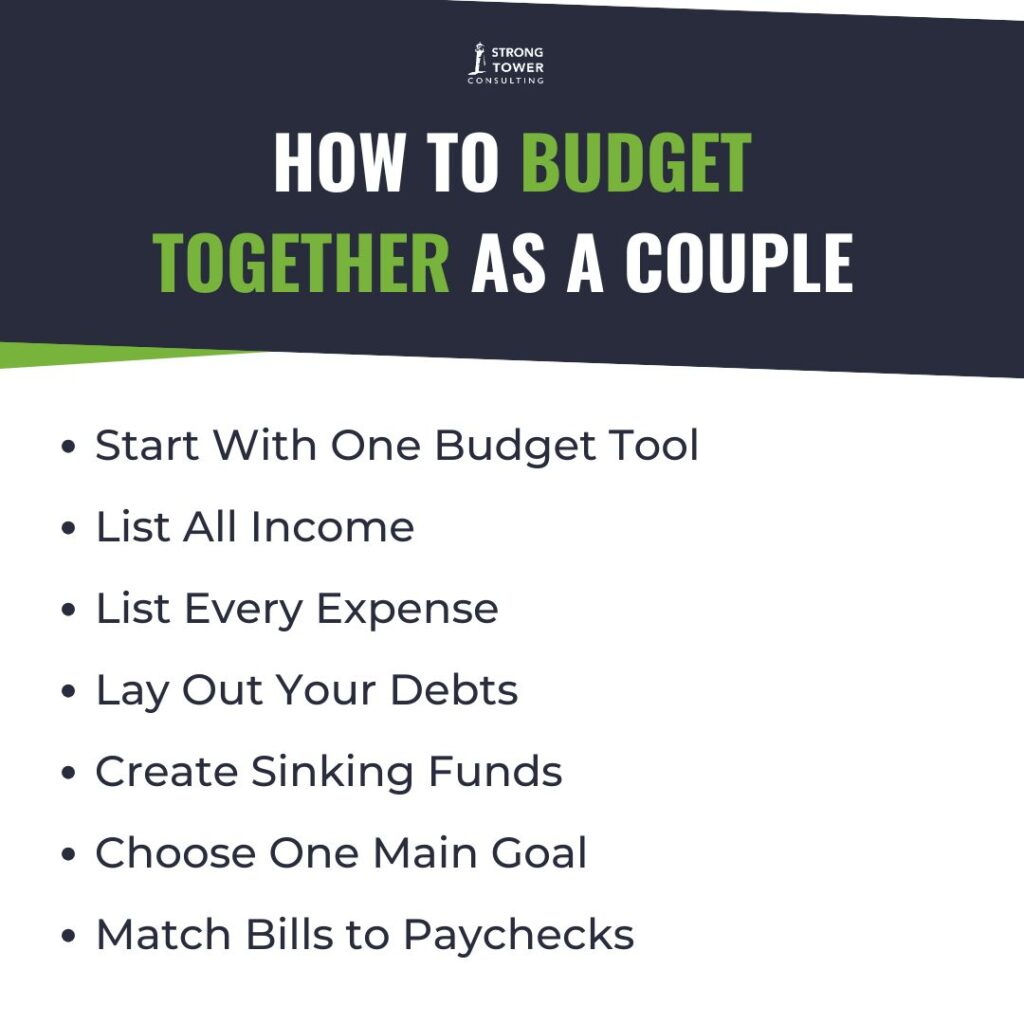

Start With One Budget Tool

Before talking numbers, decide where your budget will live. This step matters more than most people realize.

You do not need the perfect app or an advanced system. You simply need one place where both of you can see the plan. This could be a spreadsheet, a budgeting app, or even a notebook. The goal is consistency, not perfection. Choose one tool and commit to using it together. If it does not work, you can always change it later. Constantly switching tools usually keeps couples stuck.

List All Income

Next, write down every source of income coming into your household. This includes paychecks, side income, bonuses, or freelance work.

It helps to list income by pay period instead of only monthly totals. Bills are due on specific dates, so timing matters. If your income varies, estimate on the conservative side. You can always adjust later. Each dollar should be accounted for because money without a plan tends to disappear.

List Every Expense

This step often brings the biggest surprises. One of you should review your bank and credit card statements from the past one to three months. Go through everything slowly.

This is not a judgment exercise. It is simply observation. This is also where a few deep breaths and forgiveness may be needed. If you are both ready to make changes, this is not the time to judge each other for past spending choices. The goal is not to look backward. The goal is to move forward together. This can be a sticky place for couples, and it is often where arguments begin. Slow down. Stay curious. Remind yourselves that you are on the same team.

Write down fixed bills like rent, utilities, insurance, and loan payments. Then include variable spending such as groceries, eating out, gas, and personal spending. Do not forget subscriptions and recurring charges. Also include expenses that do not happen monthly, such as car maintenance, school costs, gifts, or annual fees. These are often what break a budget because they were never planned for.

Lay Out Your Debts

Looking at debt can feel uncomfortable, but it is an important step. List each debt along with its balance and minimum payment.

This is not about blame or shame. It is about understanding the full picture. You cannot create a realistic plan without knowing what you are working with. Approaching this together builds trust. You are not against each other. You are working together to solve the problem.

Create Sinking Funds

Many expenses that feel like emergencies are actually predictable. Cars need repairs. Holidays come every year. Kids grow and need new clothes.

Sinking funds help you prepare instead of panic. To create one, decide what you need to save for, divide the total by the number of months you have, and save that amount monthly. For example, if you usually spend $1,200 on Christmas, saving $100 a month removes stress when December arrives. This one habit can dramatically reduce financial tension in a household.

Choose One Main Goal

Every budget needs a focus. Trying to do everything at once often leads to frustration. Your main goal might be building an emergency fund, paying off debt, or simply getting caught up. Choose one priority together and let the budget support that goal. When couples share a clear goal, budgeting feels less restrictive and more purposeful.

Match Bills to Paychecks

Next, look at when each bill is due and match it to the paycheck that will cover it. If too many bills fall on one paycheck, that can create ongoing stress. Many companies allow you to move due dates. Spreading expenses out more evenly can make cash flow much easier to manage and help prevent overdrafts. This step alone often brings immediate relief.

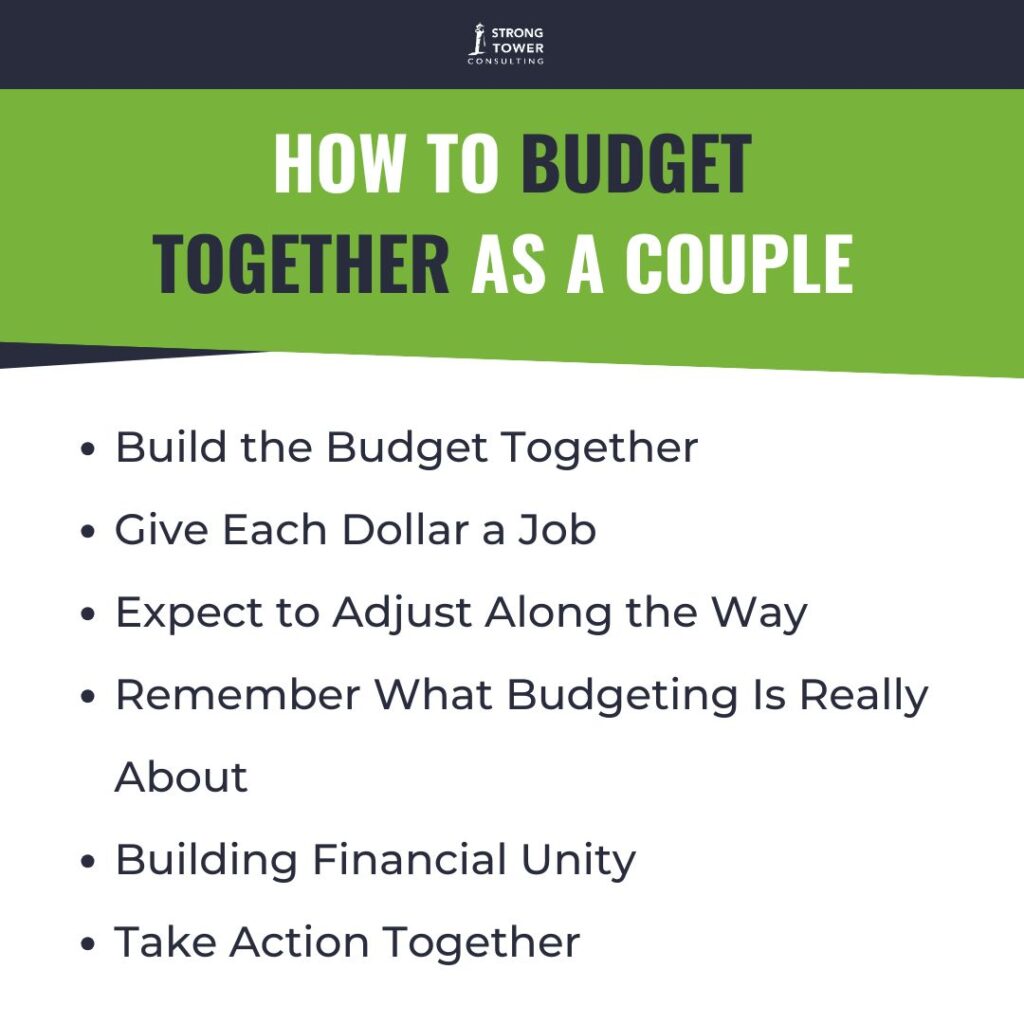

Build the Budget Together

Now combine everything into your budget tool. Include income, expenses, debt payments, and sinking funds. Nothing should be left out. Set a short weekly check-in time. Choose a regular time to meet each week and protect it. Consistency matters more than perfection. Pick the same day, the same time, and even the same place whenever possible. Maybe it is the kitchen table after the kids go to bed. Maybe it is your favorite coffee shop, as long as it fits in the budget. Using the same spot each week helps signal to your brain that this is just part of life now. Over time, that consistency turns budgeting from something stressful into a normal habit you do together, not a conversation you avoid.

Give Each Dollar a Job

A zero-based budget means each dollar has an assignment. It does not mean your bank account goes to zero. It simply means no money is left unplanned. If there is extra money, decide ahead of time where it should go. Savings, debt, or future expenses all count. Money without a job tends to disappear without notice. If the budget does not balance, adjust the categories until it does.

Expect to Adjust Along the Way

Budgets are not set in stone. Income changes. Expenses change. Life changes. That is normal, and it is okay. The key is to treat your budget like a living tool, not a rulebook.

When something changes, such as a paycheck being higher or lower than expected or a bill coming in more than usual, make sure to update the budget first. Do this during your weekly check-in, before you spend a single dollar. This small habit keeps stress, regret, and “where did all the money go?” moments from creeping in. At first, adjusting the budget might feel a little tedious, but over time, it becomes quick, automatic, and natural. Celebrate the small victories along the way, like successfully covering all bills, putting extra toward a debt, or saving a little more than last week. These wins may seem minor, but they reinforce the habit and remind you both that your money is working for you.

Remember What Budgeting Is Really About

Budgeting is not about restriction. It is about alignment. When couples budget together, there are fewer surprises and fewer emotional money conversations. Goals feel clearer, stress decreases, and confidence grows. Most importantly, budgeting helps you act on your values instead of reacting to every impulse or expense. You move from asking, “Where did our money go?” to saying, “We planned for this and it reflects what matters to us.” That shift changes everything.

Building Financial Unity

Budgeting together does not require perfection; it requires intention. Give yourselves time to learn, and expect mistakes and adjustments along the way. What matters most is that you stop winging it. When you build a plan together, money becomes something you manage as a team instead of something that divides you, and that is where lasting financial freedom begins.

Imagine waking up without worrying if bills will clear, knowing that your expenses, savings, and goals are covered. Picture enjoying date nights, family vacations, or giving generously to causes you care about—all without financial stress hanging over you. Financial freedom is not just a number in a bank account; it is confidence and the freedom to live and give in a way that reflects your values and dreams.

Take Action Together

If you want a little more guidance, my book Level Up Your Finances walks you through this process step by step. I know that getting on the same page with your spouse can feel overwhelming at first, and that’s okay. If you need a little extra support, I also offer a free coaching session to help you both align your money and goals. Learning to budget together takes time and patience, but each small step brings clarity, eases stress, and moves you closer to building lasting financial freedom as a couple.