The first step to getting on track with your finances is setting a budget. On the surface, budgeting seems exciting! It’ll get you organized and give you a roadmap to all your financial goals. However, once you sit down to make a budget, you’re probably overwhelmed by all you have to figure out.

It’s not just how much you want to spend on groceries, it’s annual bills, Christmas savings, hair appointments, and so much more! Often when I help people make budgets, it takes about three months for the client to “catch everything,” which means most clients have a few extra months of financial turmoil.

To help you skip this stressful transition, I’ve created a list of common expenses that people miss. Once you’ve finished your budget, make sure you include any of these line items that apply to your situation!

16 Forgotten Budget Items that Can Wreck Your Budget

What does a budget look like?

A budget should be a spreadsheet (digital or analog) that includes all your income and expenses. Each month, the budget should be manipulated and changed based on what’s going on in the days ahead! No two weeks are the same, let alone a month, so your budget needs to be updated frequently.

A good budget is also organized into due dates and paychecks. That way, you always have enough in your account to cover the bills for that week. On a budget, you should also track how much you’re paying into savings and debt. In short, your budget should include ALL transactions.

Should everything be budgeted?

Some people have the urge to create a “miscellaneous” category in their budget. This makes sense on the surface, but it just doesn’t work! Trust me, with all my clients over the years, it’s never worked once. Having $150 set aside might cover new shoes after one of the kids wears a hole through the bottom, however it’s not enough for the month you need 4 new tires.

Your budget should include everything and be really specific. Whatever expenses are coming up in the next 30 days needs to be on your spreadsheet, in addition to necessary sinking funds for repairs, Christmas, birthdays, and other known upcoming costs.

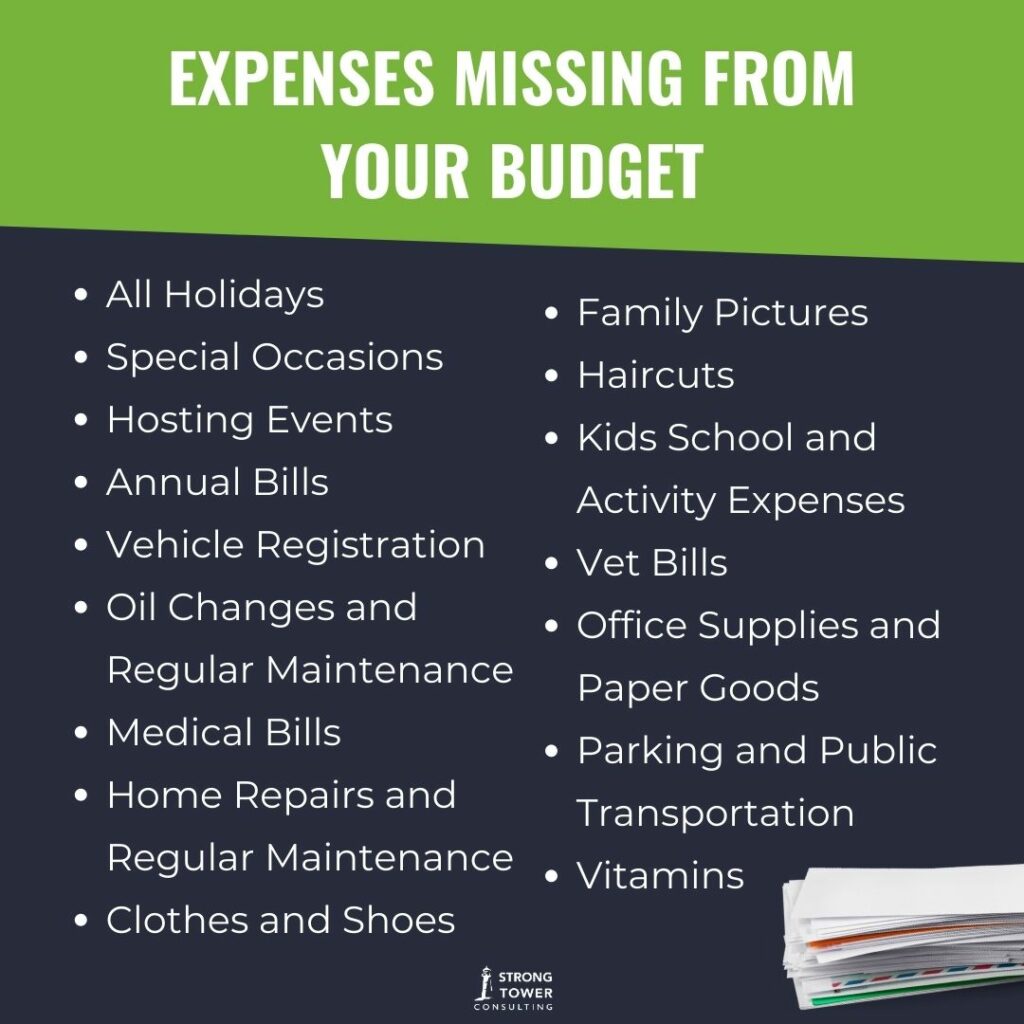

16 Expenses Missing from Your Budget

All Holidays

You may have Christmas in mind all year round, but what about the other holidays? Of course, a Christmas savings is important starting January 1st, however determine what you’ll need for other holidays you celebrate as well. Valentine’s Day, Easter, Independence Day, and Halloween can all cost a pretty penny too!

Special Occasions

If holidays weren’t enough, there are plenty of other special occasions that cut into your budget. Formal clothes, event tickets, meals, flowers, and more come with big events. Think about upcoming weddings, proms, award nights, and birthday parties that you’ll need to account for.

Hosting Events

Whether you host events regularly or a couple times a year, it needs to be in the budget. There’s food, drinks, and toiletry expenses when hosting people. And, that’s not including any rented amenities or decor!

Annual Bills

Almost everyone has bills that come out once a year. Anti-virus software, Google Drive storage fees, Amazon Prime membership, pest control, yearly maintenance checks, and plenty of other things come out annually. Determine the due dates for all these bills and don’t be surprised.

Vehicle Registration

This one sneaks up on all of us! Include annual vehicle registration and taxes into your budget. Try to remember how much they were the year prior too, so you can budget appropriately.

Oil Changes and Regular Maintenance

Speaking of vehicles, don’t forget about oil changes and regular maintenance. Taking your car through a car wash once in a while and paying a few dollars to get the tires aired up should be included in your spreadsheet, too.

Medical Bills

I am not talking about medical debt here. I am actually talking about new medical expenses that we want to cash flow! Save a little each month for medical bills, and if you have a regular physical therapy appointment or annual check-up, make sure you have the funds to cash flow it before the day arrives.

Home Repairs and Regular Maintenance

Just like your car, your home needs regular maintenance and repairs. Set aside a bit each month, and if you already know you need to get something new or hire someone to come out, include the estimated cost in your budget.

Clothes and Shoes

Depending on who you have in your household, this one may not be important. Two adults don’t need new clothes while they’re getting out of debt. However, kids need new clothes and shoes every time you blink! Your clothing budget needs to be set, so no one is stressed when pants get too short and the basketball shoes don’t fit this season.

Family Pictures

If you get regular family pictures, budget for the cost of the photographer and the price of getting the photos printed. Both can be a significant expense!

Haircuts

Note the price of your haircuts each visit and plan when and how you’ll pay for that each time it comes up.

Kid School and Activity Expenses

School lunches, field trip fees, activity membership, summer camp, sport’s fees, yearbook costs, homeschool curriculum, and classroom supplies are just a few random expenses you may experience month-to-month if you have children.

Vet Bills

Budget for regular vet costs like check-ups, but have a small savings for emergency vet bills as well. That way, if Fido needs a surgery or treatment, you’re not stressing about how you’ll pay for it all.

Office Supplies and Paper Goods

The world isn’t as pen-and-paper as it used to be, but we still need office supplies! Once in a while, you may need toner, ink, tape, or staples. If you know you’re getting low, include that in next month’s expenses. Additionally, include what I call “paper goods,” which is laundry detergent, paper towels, toilet paper, light bulbs, and other non-grocery grocery store necessities.

Parking and Public Transportation

This one doesn’t apply to everyone, but if you need to rideshare, take public transportation, or park frequently on the street, budget for transportation expenses. A few dollars for each of these things may not seem like a lot, but it can really add up if it’s not on the spreadsheet..

Vitamins

Supplements probably don’t belong in any category you currently have on your spreadsheet. This is exactly the kind of thing that throws your budget! Keep taking your vitamins, just include the cost in the budget.

Track these forgotten expenses to ensure you have a balanced budget!

A good budget includes it all and evolves as your life does. When every month is well planned, you’ll get freedom from your stress and reckless spending. The feeling of control doesn’t just affect your mental state, but it drives you closer to your financial goals, too. Most people say after they budgeted, it felt like they got a raise.

If you need help with your budget, I’d love to assist as a trained financial coach! First, let me get to know you in a free financial coaching session, and then I can show you the beauty of a zero-based budget. This is your first step toward financial freedom!