It’s that time of year again. No, not Christmas, tax season! Depending on who you are, tax season either feels like Christmas or a curse. If you’re in that first camp, and tax season for you means a big refund check, you’re probably already planning how you’ll spend your refunded cash.

Too many of us forget our money goals when extra money comes in, yet, these extra dollars can be just what we need to propel us forward into the next “Baby Step” or financial stage. So, today, we’re discussing all things tax refunds and sharing some ways you should spend that refund—and some ways you definitely SHOULD NOT spend that refund. Here’s what you need to know about your income tax refund:

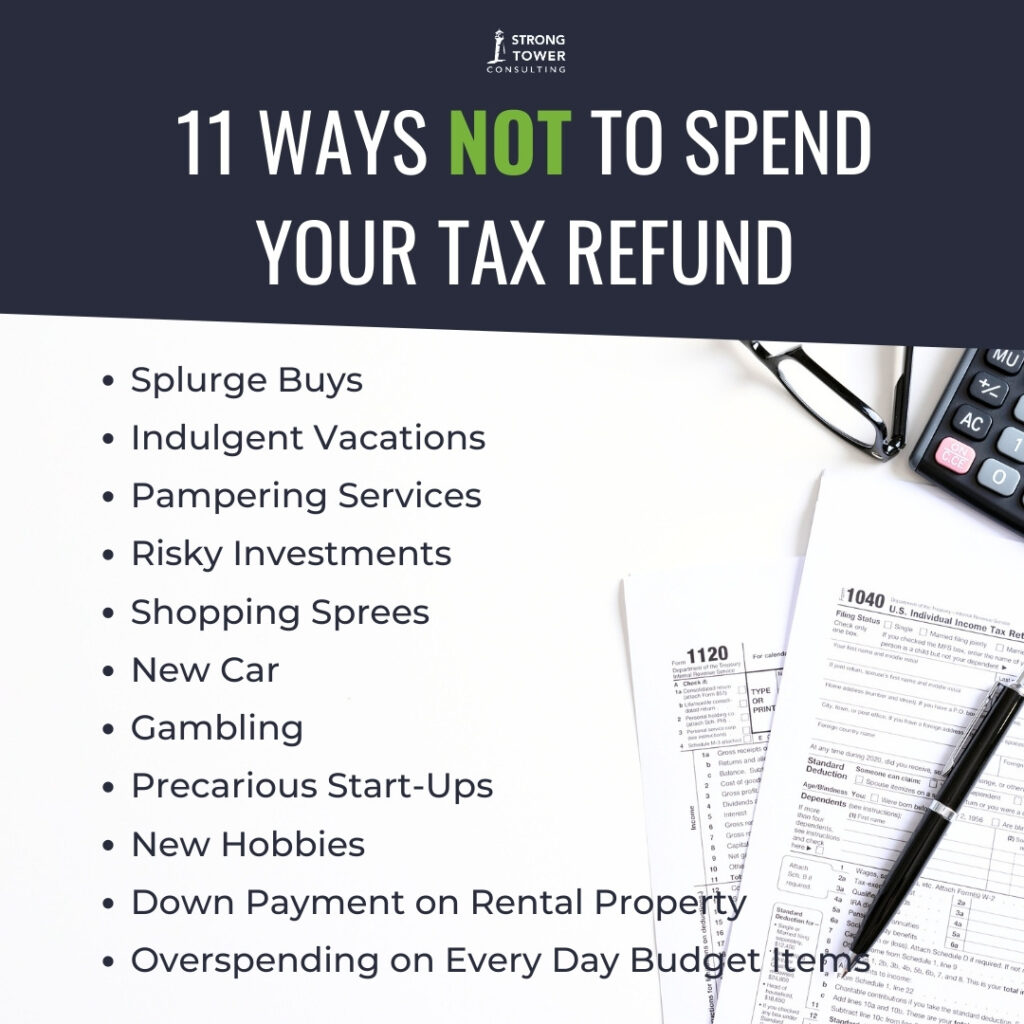

11 Ways Not to Spend Your Tax Refund

Should I Get a Tax Refund?

If your taxes are set up properly with work, you should not receive a refund. The goal is to only have the government take what is required, and you keep the rest on your bi-weekly check. When the withholding amount is correct, you should get $0 back from the government and owe them $0. This is the best way you can ensure your income works for you all year round!

That being said, there is no legal penalty for having the government withhold more. You’re just loaning the federal government your money! So, not getting the refund is more of a matter of principle. Wouldn’t you prefer to make more weekly than get a big check in April? Do you really want the government holding onto your money for a year and giving it back at their discretion? Yeah, I didn’t think so. Talk with your employer about adjusting your withholdings.

11 Ways Not to Spend Your Tax Refund

Splurge Buys

There are plenty of items that seem out of our reach most of the year. Maybe it’s a boat. Maybe it’s a fancy grill or designer piece of furniture. Or, maybe it’s a top of the line lawn mower or laptop. Whatever it is, do you find yourself looking at the constant social media ads advertising these luxury products, wishing you had the kind of income to afford something like that?

If so, a sudden wave of cash from a tax refund or work bonus should NOT change your mind. If you’ve got debt, low savings, and you struggle to pay your bills, that few thousand dollars in your bank account is not changing your financial position—especially if you blow it all on a luxury item you don’t need.

Indulgent Vacations

You might be working really hard to get out of debt and reach your savings goals. Does that warrant a little award when that tax refund comes? Sure, but I’m thinking something on the lines of dinner at Applebee’s—NOT an indulgent, all-inclusive vacation.

It’s tempting to schedule that trip with the money sitting right there, but focus on your financial goals. I’ll never forget a couple I worked with who went against my advice and went on a big vacation while getting out of debt. When they returned, they promptly communicated that the vacation was a bad idea, because all they could think about was the money they were spending and the irresponsible decision they were making. It was a lesson learned, and they refocused on getting out of debt right after this little mishap!

Pampering Services

Another way you don’t want to spend your tax refund is on pricey pampering services you wouldn’t have done otherwise. Hair blow-outs. Elaborate beauty treatments. Fancy nails. Tattoo sleeves. Deep tissue massages. All these things feel great, but they’re not essential.

Spending a few hundred to a thousand dollars on something cosmetic is probably not the best investment. These things are superficial, and in most instances, temporary. Put your money where it matters while you’re working through the Baby Steps.

Risky Investments

There are lots of new and old investment opportunities out there that bring tons of risk. You may not have been comfortable investing in these things before the refund, but this sudden influx of cash has you second-guessing the possibilities. What if you made millions with that invention? What if your friends’ business really takes off? Or, what if these Beanie Babies are worth a lot someday?

Okay, I doubt anyone is getting fooled by Beanie Babies in 2025, but you get the point. Risky investments are still risky investments. When you’ve paid off all your debt, you have a fully funded emergency fund, you’re putting money in retirements, and you still have a surplus of cash, we can discuss these investments with an investment professional. Until then, however, invest in more secure ways and stay focused on your financial goals. (Remember, if something sounds too good to be true, it probably is.)

Shopping Sprees

A little retail therapy never hurt anyone, right? Wrong! Unbudgeted shopping sprees are your quickest avenue to regret and debt! Your tax refund should be working for you and your financial goals. If it goes to random non-essential purchases that aren’t worth anything, you’ll be deprived of the momentum you could feel if you placed the money somewhere else.

Imagine instead of spending the money your usual way, you paid off a credit card that’s maxed out because of your shopping habits. Wouldn’t that feel good?—like a step in the right direction? Kick those bad habits to the curb, and use your tax refund money where it actually counts.

New Car

You’re probably not getting a large enough tax refund to buy a brand new car. So, if you’re considering getting a new car with your tax refund money, what you’re really planning on doing is going into debt with it! Sure, the money might be a decent down payment, but those monthly payments will come back to haunt you when the extra cash runs dry. (Plus, you can always get a reliable used car for MUCH less.)

Gambling

Want to turn that tax refund into an even bigger chunk of change? Well, don’t do it gambling. It’s estimated that only about 2%-13% of bets are profitable. That is not a hopeful statistic! Instead, if you’re at the stage where it’s time to start investing, get an investment pro and consider putting money in mutual funds or your IRA.

Precarious Start-Ups

I love the entrepreneurial drive. I really do! However, if your family is struggling to make ends meet and you get a “good tax refund” (I don’t like that phrase), you shouldn’t spend that money on a new business venture.

This includes a business you personally want to start, a business your friend is starting, or that multi-level marketing company your old high school friends have been messaging you about. They’re all too risky and involve too many additional costs once you get in. If you want to start a business, wait until you have the savings built up and you’ve conquered all the Baby Steps. Once you get there, shoot for the stars and open up that new business! (But, it’s probably best to hold off right now.)

New Hobbies

Have you been dying to start a new hobby, but you haven’t had the funds to get the materials? Today is not the day to start. Whether you want to begin woodworking, cake decorating, refurbishing old cars, fishing, or raising saltwater fish, getting started isn’t cheap. Though the extra funds might be tempting to use on a new hobby, it may not be wise while you’re working yourself out of a financial hole. You may not even like this hobby as much as you think!

Down Payment on Rental Property

You’ve heard it before: If you get a rental property or AirB&B, someone else can pay your mortgages for you and then some! It sounds great. It sounds like a good investment . . . let me tell you, having a rental property is NOT easy, and it’s not cheap. Between managing repairs, tenants, and billing, it’s a huge headache, and not a guaranteed payout. A bad tenant or renter could leave you high and dry with not one mortgage . . . but two. Stay away from spending your refund on a rental property down payment.

Overspending on Every Day Budget Items

This is a big one. If you’ve been diligently following a budget, that tax refund might hit your account and you decide to take a break. Who cares how much we spend on groceries? So, what if we go out to eat more than usual? Does it really matter if you bought the kids new shoes they didn’t need?

First of all, in order to stay disciplined with a habit, you have to do it every day. Letting go of your budget one month will make it very hard to pick up again next month. And, don’t forget this is what you were doing before your budget—just spending without real regard for what you were buying and how much it costs. This way of living leads to debt, overdraft fees, and worst of all, no forward progression on all your money goals.

Should I Take a Refund Advance?

Many people don’t understand what a refund advance is. Guys, it’s a loan! This is no different than pay-day lending, which means you get your cash, but at a high cost. There are tons of fees, plus these loans have high interest rates.

So, taking a refund advance could actually put you deeper in debt, especially if there’s a problem with your refund. That money could take a while to get to your account, or the IRS could demand your refund be amended. If the refund amount is wrong, you may owe the lender even more. Don’t turn your refund into debt!

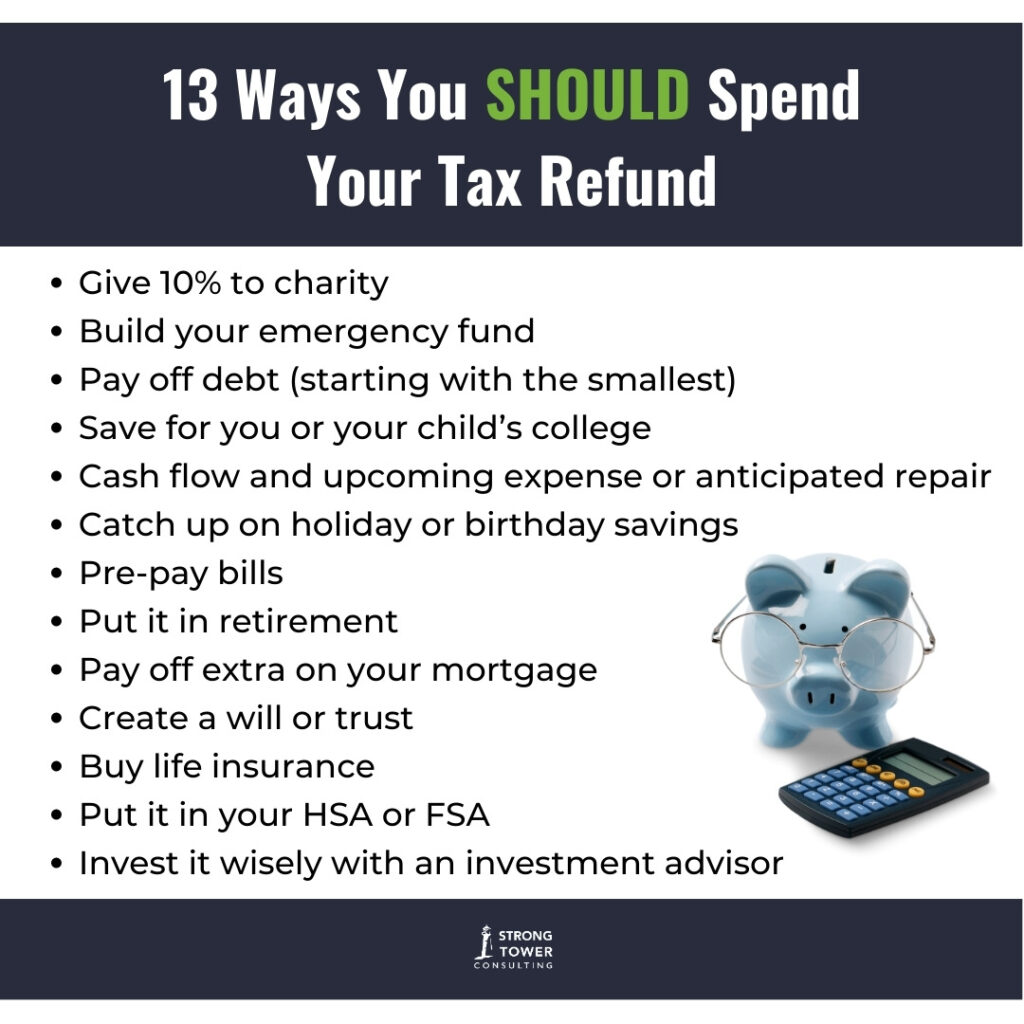

13 Ways You Should Spend Your Tax Refund

- Give 10% to charity

- Build your emergency fund

- Pay off debt (starting with the smallest)

- Save for you or your child’s college

- Cash flow and upcoming expense or anticipated repair

- Catch up on holiday or birthday savings

- Pre-pay bills

- Put it in retirement

- Pay off extra on your mortgage

- Create a will or trust

- Buy life insurance

- Put it in your HSA or FSA

- Invest it wisely with an investment advisor

Spending your tax refund wisely can set you up for financial success.

Money that comes from your tax refund is not free money the government generously gave you. NO WAY. This is your hard-earned money that the government has held back from you. What you’re getting back is your income from working your 9-5, so you should spend it like it matters! Respect yourself and your money goals by spending your refund wisely and staying focused on all your financial future. If you need help developing your budget and financial plan, check out our blog and meet with me for a free financial coaching session! We can do this together!